It’s no surprise that oil and gas CEOs are increasingly concerned about the business challenges of today and the future. During one of the worst years in the industry’s history, 72% of oil and gas CEOs told us that there are more threats facing their business today than there were three years ago. Geopolitical uncertainty, over- regulation, climate change and an increasing tax burden are among their biggest concerns. Technology will likely play a key role in helping the sector improve, not only operationally, but in terms of improving stakeholder relationships, managing talent, and risks.

Growing in complicated times

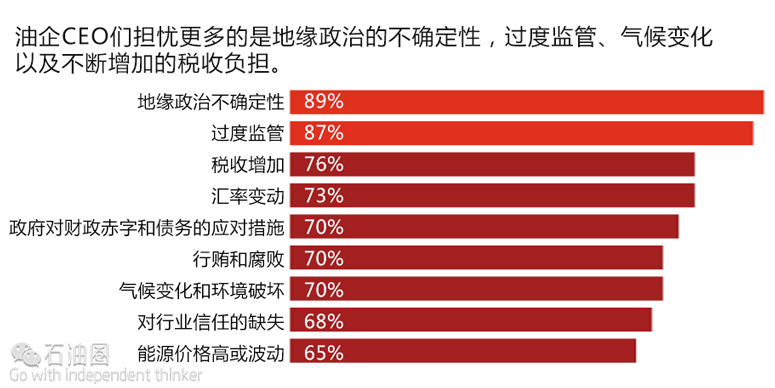

Today’s CEOs face a business environment that’s becoming increasingly complicated to read and adapt to. The top two concerns for oil and gas CEOs – geopolitical uncertainty and over- regulation – are the same as those which worry CEOs across the sample, but the level of concern is even greater. 89% of oil and gas CEOs are concerned about geopolitical uncertainty – the most of any industry – compared to 74% across the entire sample, while 87% are concerned about over-regulation, compared to 79% of all CEOs.

Oil and gas CEOs are also deeply concerned about an increasing tax burden (76%), as well as about government responses to fiscal debt and deficit (73%).

All of these issues are having an impact on confidence in the global economy. Like their peers in other industries, oil and gas CEOs are less optimistic about global economic growth this year, with just 27% expecting it to improve, down from 35% last year.

China’s economic rebalancing and the fragility of its debt-laden local government and private sector continues to spook investors and rattle entire industries. One of these is the oil and gas industry, which is suffering from slowing demand growth, not only from China, but globally. Over-supply in the industry coupled with lower demand have driven oil prices down dramatically. And the imbalance looks set to worsen this year, leading many (including PwC’s Strategy&) to expect prices to stay “lower for longer.” There’s little doubt that the industry environment has become a lot tougher for most companies; 72% of oil and gas CEOs say there are more threats facing their business today than there were three years ago.

Surprisingly, though, confidence levels have remained fairly stable, with 28% of oil and gas CEOs very confident of revenue growth over the next 12 months, down just one percentage point from last year. Our sample includes industry players from across the value chain, so some of this optimism may be coming from some downstream companies that are generally benefiting from low oil prices.

Oil and gas companies have undertaken major restructuring and cost-cutting in the recent past, in response to the sharp drop in oil and gas prices, which shows no sign of reversing in the immediate future. According to our survey, this activity is continuing: 68% of CEOs plan cost- cutting in the next year. We believe it will be important for CEOs to be selective in their cuts; arbitrary cost cutting can leave an organisation ill-prepared for an uncertain future.

Tax is on the minds of oil and gas CEOs too – 46% of them are extremely concerned that an increasing tax burden could threaten growth. Oil and gas CEOs rate a clearly understood, stable and effective tax system #1 on their list of priorities for governments, ahead of availability of key skills (the top choice of CEOs overall) and high levels of employment. They’re most interested in stability – 80% agree or agree strongly (vs 67% of CEOs overall) that a stable tax system is more important than low rates of tax. And oil and gas CEOs are also more likely to agree strongly (46% vs. 36% overall) that tax is a business cost that needs to be managed efficiently (as per other business costs).

76% of oil and gas CEOs agree that their business’ approach to tax affects their reputation, and 66% indicate that they are planning to make some or significant changes to their tax affairs.

Addressing greater expectations

Oil and gas companies don’t just need to cope with the immediate price environment. The industry is also facing a period of significant transformation, driven by important global trends. Like their peers in other industries, oil and gas CEOs believe that technology advances will transform wider stakeholder expectations of businesses with their sector over the next five years. Given the nature of the sector and the continuing importance of the climate change agenda, it’s not surprising that far more oil and gas CEOs rank resource scarcity and climate change as one of the global trends most likely to transform wider stakeholder expectations of their industry over the next five years (69% versus 43% of CEOs overall). And more oil and gas CEOs see a shift in global economic power as likely to transform expectations – most likely because emerging economies will be driving increases in demand for energy.

For most industries, customers are by far the most important stakeholder. In the case of energy, however, more oil and gas CEOs say that governments and regulators with have a high or very high impact on their strategy, echoing the industry’s strong level of concern around regulation and the large number of companies that are state-owned (20% of our oil and gas survey sample has some form of government backing).

Challenges are coming from all directions.

Oil and gas companies are on the front line of climate change regulations, with fossil fuel emissions targeted for reduction. They also operate in a number of areas where political conflict has created uncertainty. In some oil and gas producing countries, production has been threatened; others have been subject to economic sanctions. And the future remains highly uncertain in many regions. Environmental regulations can also have a major impact on exploration – and in some cases, investments undertaken under one regulatory regime may be jeopardised when a new government takes office.

What do you stand for?

Oil and gas CEOs have long experience in understanding and managing expectations, and some companies in this sector have comprehensive stakeholder engagement programmes. Hence 58% told us they’ve always had an organisational purpose that reflects broader social expectations, compared with 45% overall. Another 21% say they have changed their purpose over the past 3 years to take their broader impact on society into account.

Despite that, oil and gas CEOs are more likely to say that their company’s purpose is centred on creating value for shareholders, rather than wider stakeholders (45% vs. 32% overall).

Transforming: technology, innovation and talent

Most oil and gas CEOs recognise the needs of a wider set of stakeholders and are taking them into account, but that’s an increasingly difficult task in a multipolar world.

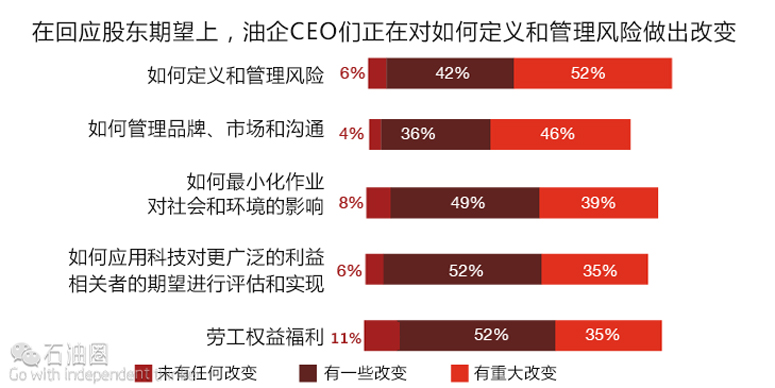

Even the most committed can find it challenging in the extreme to reshape their company while facing day-to-day battles on every front to fight off competition, grow revenues and cut costs. Nearly every oil and gas CEO we surveyed (94%) is planning at least some changes to how their company defines and manages risk in order to respond to changing stakeholder expectations. They’ll work harder to get the word out about their business, too: 46% expect significant changes in how they manage brand, marketing and communication. And 39% say they will make significant changes to minimise the social and environmental impact of their business operations.

That’s not to say it will be easy. Nearly half of oil and gas CEOs see additional costs to doing business (49%) and unclear or inconsistent standards or regulations (49%) as a barrier to meeting stakeholder expectations, and around a third (32%) mention conflicts between stakeholder interests and financial performance expectations.

When it comes to their stakeholder engagement programmes, oil and gas companies rate data and analytics as the top connecting technology (59%), followed by CRM systems (52%).

Compared to other sectors, though, oil and gas companies don’t rate these technologies as high. These results may be explained by the fact that oil and gas companies have comparatively fewer customers compared to, say, a consumer goods manufacturer. Oil and gas companies are also much less likely to use social media than overall, (35%, versus 50% overall).

John J. Christmann IV, Chief Executive Officer and President of US-headquartered Apache Corporation, singled out better data as his company’s technological ‘holy grail’: “I’d like to have technology by which we could take all our data, modernise it, and put it at our fingertips. We have warehouses full of old paper data and information… …In the end, we live and die by gathering and analysing good-quality data, so if I could do that quickly, it would save us a lot of time, effort, energy, and money, and move us ahead.”

Talent challenges are intensifying

Apache Corporation’s John J. Christmann IV told us how demographics are set to intensify talent shortages in the industry: “Historically, the talent flow in and out of our business has tended to track oil prices and the commodity cycle. There was a big gap from 1985 to 2000, when not very many people entered this business, and at this point in time we’re reeling a little bit because there aren’t a lot of seasoned technical staff in the 40-50 age group.”

We asked CEOs what aspects of their talent strategy they’re changing to make the greatest impact on attracting, retaining and engaging the people they need to remain relevant and competitive. For oil and gas CEOs the top three priorities were the pipeline of leaders for tomorrow (52%), workplace culture and behaviour (42%), and effective performance management (38%). Surprisingly, though, very few oil and gas CEOs say they plan to make changes to their focus on productivity through automation and technology (11%) or the use of predictive workforce analytics (just 1%).

Measuring and communicating success

How should business be doing more in order to measure impact and value as stakeholder expectations evolve?

Oil and gas CEOs listed key risks, innovation and environmental impact at the top of their list of areas they want to measure better. Oil and gas companies operate all around the globe, under all different types of terrains and environments. As with any extractive industry, there are environmental considerations, and the oil and gas industry is highly scrutinised by the general public, regulatory agencies, the media and more. The ability to better measure and communicate about some of their risks and efforts to minimise environmental impact would help them improve their global image.

More than three-quarters (76%) of oil and gas CEOs say their company reports on both financial and non-financial matters and 70% of oil and gas CEOs agree that business success in the 21st century will be defined by more than just financial profit.

Apache Corporation’s John J. Christmann IV summed up some of the areas where the industry needs to communicate better and described the strong committment to making a difference he sees in his company’s employees: “Our industry as a whole does a lot of good things, but we have this bad big oil image that dates back to the 1970s and 1980s. When you look at what we do for the environment, what we do for society, we have a philosophy of investing where we live.

We donate a lot of money in those communities. Our employees are very engaged and involved in philanthropic events.

The younger generation loves getting out and making a difference, which they measure in terms of where they choose to work. Our industry provides a needed service. Energy is something that this country needs. Obviously, we want to provide it as cleanly as we possibly can, and we have goals and measures in terms of how we protect the environment and our safety record. Our objective is to provide, explore, and find hydrocarbons and then give back to the communities where we live.”

“I don’t have a crystal ball on oil prices. I try to control what we can control. That’s why we’ve been focused on our cost structure at three various levels – our capital cost to drill new wells, our lease operating expenses, and then our G&A. The bottom line is, we’ve had to push the reset button and really attack the cost structure to gear for a lower-price environment.

石油圈

石油圈