Our 14th Capital Confidence Barometer defines the oil and gas M&A market to be driven by asset sales from cash-constrained companies. The changing dynamics within the M&A market is moving it from one that has been relatively seller-friendly for the last decade, to one where the buyers are in bargaining position.

Last year, this dynamic manifested itself with deal volumes in the upstream falling significantly and a huge buildup in unsold assets, remaining in the market for a considerable period. The valuation price gap made it very difficult for sellers and buyers to agree on a price. Now, with greater consensus around a “lower for longer” outlook shrinking the valuation gap, we are likely to see more deals come together during the next 6–12 months.

Macroeconomic environment

The global economy is stable however, the slowdown in Europe continues and the ongoing reforms in China will result in much lower growth from the country. Countries that have high dependence on oil and gas revenue have been forced to make major cuts to expenditure and slash subsidies to balance their budgets. As a result our survey respondents — both for our global sample and our oil and gas sample — are a bit more cautious than they were six months ago.

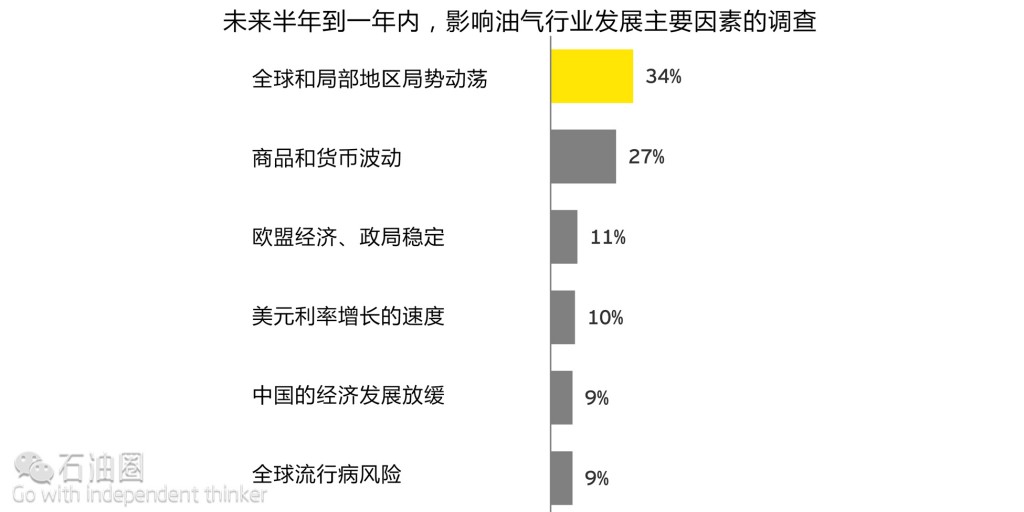

34% see increased global and regional political instability as the greatest economic risk over the next 12 months.

Cautious optimism is the order of the day

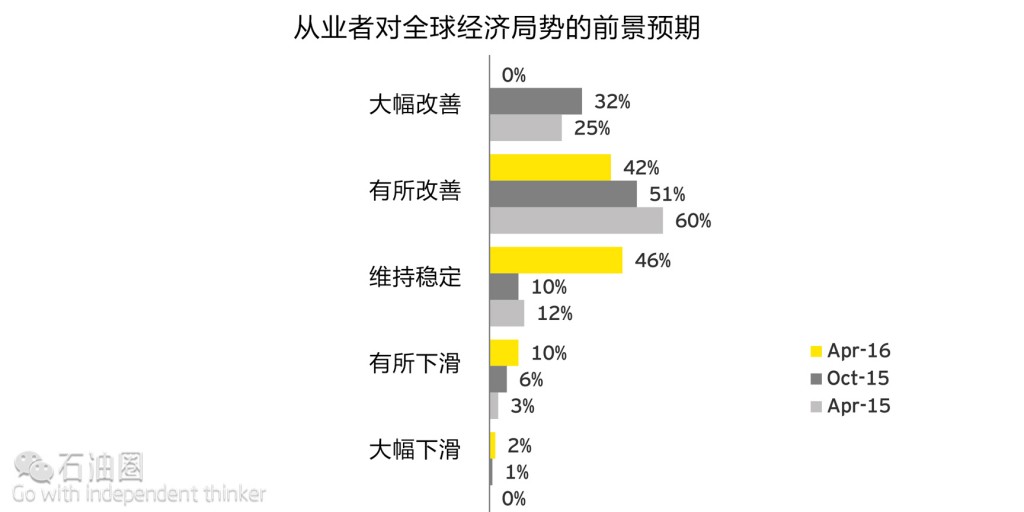

More than 40% of the oil and gas company respondents believe the global economic situation is improving, but that is a sharply lower percentage than the 85% who felt that way in April 2015. There has also been a corresponding increase in the number of companies who view the economy as stable, from 12% to 46%. Notably, oil and gas companies are slightly more optimistic than the broader global sample of respondents.

Q: What is your perspective on the state of the global economy today?

Lower confidence on earnings and credit availability.

A steep decline in crude oil prices, which reached multi-year lows in January, has shaken the oil sector; despite recovery, prices continue to hover around the US$40 mark. As a result oil and gas executives’ confidence outlook on all major issues such as earnings, valuations, short-term market stability and credit availability has shifted from positive to stable.

Q: Please indicate your level of confidence in the following at the global level.

Key economic risks

Increased global instability and volatility in crude oil price are key economic risks

Not surprisingly, more than one-third (34%) of the oil and gas company respondents see increasing global political instability as the key economic risk to their business. Oil and gas executives continue to perceive significant geopolitical risks, especially in the Middle East due to growing tensions between various major players.

Higher crude oil price volatility has severely impacted the oil and gas sector, with upstream-focused companies bearing the brunt. More than one-quarter (27%) of the oil and gas respondents believe increased volatility in commodities and currencies is their key risk. Continuing volatility in commodity prices is restricting companies’ ability to plan in the near term.

Q: What do you believe to be the greatest economic risk to your business over the next 6–12 months?

Corporate strategy

A more conservative view in oil and gas price outlook has become the consensus within the industry. Combined with the pressure on profitability attributable to costs, which increased significantly during the last decade, this view is driving an increased focus on reducing costs. Focus on optimization of business with a view to simplify and accelerate decision-making in a low oil price environment leads companies to continue to reduce their work force. Joint venture arrangements have also become more popular as an option, as they reduce a company’s capital outlay and also broaden its offerings.

43% are focused on making better use of digital technology and analytics to drive growth in the next 12 months

Boardroom agenda

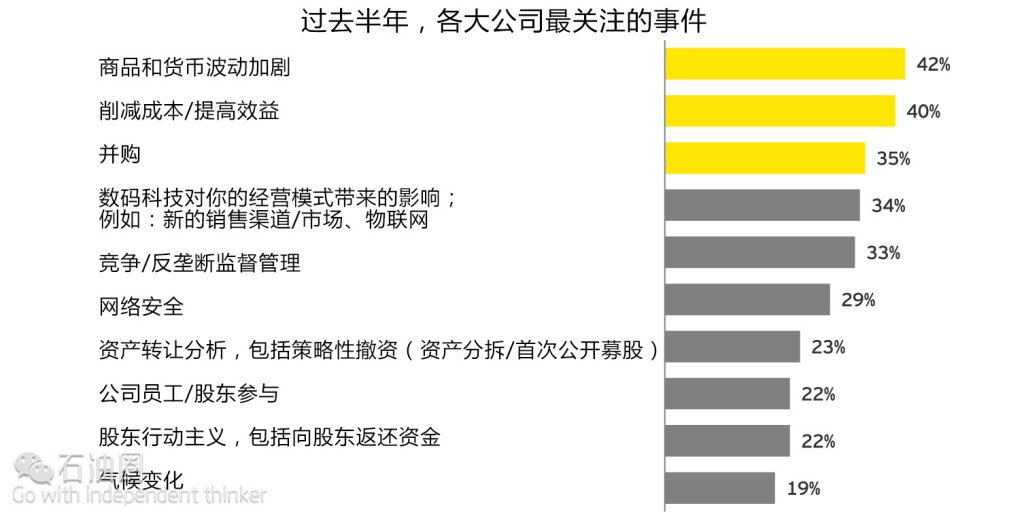

Reducing costs and improving margins is no. 2 on the boardroom agenda

A steep increase in oil price volatility has placed risk management as a key focus area; more companies are exploring options to hedge their exposure.

Cost reduction has become equally important as oil and gas executives accept that oil prices may remain lower for a longer period. Oil and gas companies are looking to streamline their operations and ensure that the cost reductions achieved are permanent. Major oil and gas companies have increased use of digital and data analytics to optimize their upstream and downstream operations.

Acquisition is also high on the board room agenda of the stronger companies, as financially stronger companies would like to use the current environment to make acquisitions that strengthen their portfolio or provide access to new markets and technologies.

Q: Which of the following has been elevated on your boardroom agenda during the past six months?

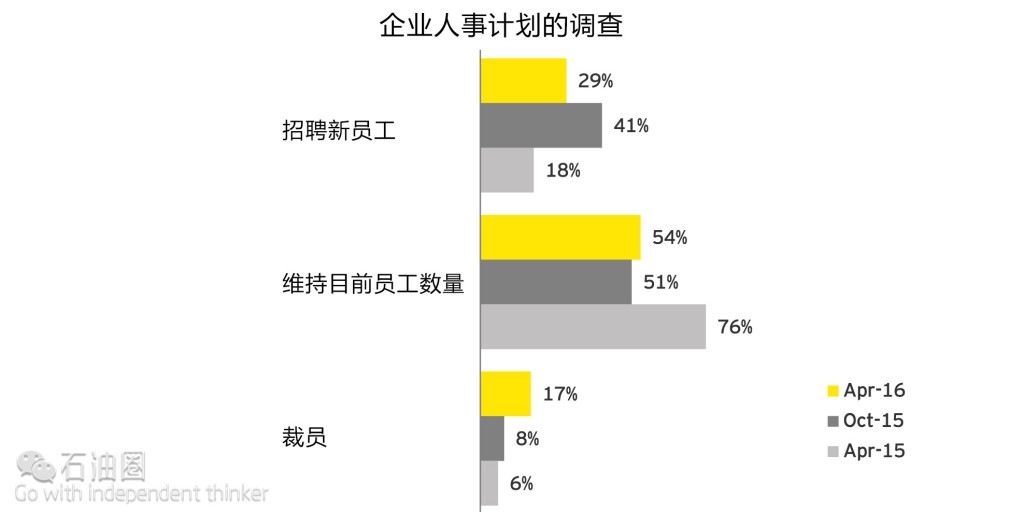

Reduction in workforce possible

While 83% of oil and gas companies plan to maintain work-force levels, critically the number of oil and gas companies that plan to reduce workforce has almost tripled during the last 12 months. Since the beginning of the price crash in 2014, oil and gas companies have laid off more than 250,000 employees (Source: Bloomberg).

Increased focus on optimization of business with a view to reduce layers and achieve faster decision-making in a low oil price environment leads companies to continue to lay off work force.

Q: With regards to employment, which of the following does your organization expect to do in the next 12 months?

Alliances join M&A as engines of growth

Joint venture is the preferred option to monetize assets and improve competitive position.

While acquisitions are on the agenda, oil and gas executives are also looking at alliances as a means to monetize their assets and thereby increase return on capital.

Alliances also help service companies fill gaps in their offerings and provide an opportunity to make joint bids for major projects. Alliances are quite common when it comes to mega-sized or complex projects, as they help mitigate individual participants from the financial risks involved.

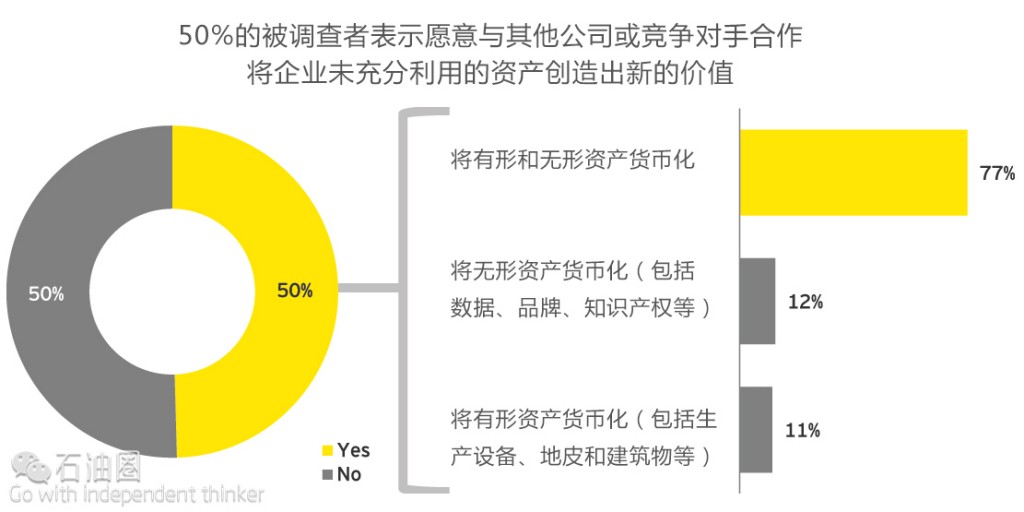

Q: Are you planning to enter alliances with other companies or competitors to help create a value from underutilized assets? 50% responded yes, what is the primary reason?

M&A outlook

Oil and gas M&A activity in the upstream (barring one major deal) and OFS collapsed last year; midstream and downstream sectors were quite active due to continued though declining activity in the MLP space, and continued divestment of downstream assets by the majors. While M&A activity in Q1 of 2016 continues to be slow, the majority of oil and gas executives are optimistic that it will improve in the next 12 months. While the cash crunch is forcing upstream companies to divest assets, over-capacity in the OFS market is forcing companies to consolidate to cut costs and manage through the current down-turn. Midstream and downstream deal markets remain positive, as they are good options for companies that wish to monetize their assets at reasonably attractive prices.

32% of failed acquisitions cite the gap between buyer and seller expectation as being too wide.

Executives positive about acquisition opportunities

While oil prices tended to remain low, increasing stress on the US shale sector, there was optimism that mergers and acquisitions would materialize. In anticipation, private-equity houses set aside billions of dollars to acquire assets. However, the expected deal activity did not pick-up.

As a result, oil and gas executives have now tempered their expectations. While executives are positive about the number and quality of acquisition opportunities in the market, there is a drop in the perceived likelihood of closing acquisitions. The likelihood of closing is still higher than 12 months ago, with more than one-third of respondents confident of closing a deal in the coming quarters.

58% expect the oil and gas deal market to improve over the next 12 months.

Narrowing of valuation gap to accelerate M&A

An increase in oil price volatility had led to a wide valuation gap between buyers and sellers and was the main hurdle to the pick-up in M&A. Around 50% of the oil and gas respondents now feel that the valuation gap between buyers is moderate to quite small; the highest during the last 12 months. With some expectation for the valuation gap to widen due to increase in price of assets, oil and gas companies could be keen to close some of the deals in their pipeline.

52% expect the valuation gap between buyers and sellers will remain at current levels or decrease in the next 12 months.

石油圈

石油圈