Satellite imagery

A picture can change dramatically solely based on one’s point of view. A tree in the distance can look 2-D until a person is either below it or above and sees its complete 3-D footprint. Elevation also can change perspectives, making the difference between seeing a fence and what lies on the other side.

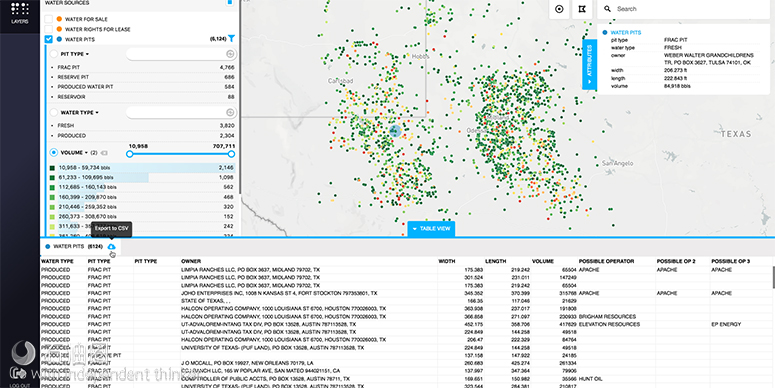

Sourcewater is using perspective to gain a competitive advantage when it comes to oilfield water intelligence and overall operator activity. The company is using machine learning and computer vision analysis of very current satellite imagery of the Permian and other plays to detect every single frac pit and every single well pad to predict who is going to be drilling where and when.

“Today, everybody does that by looking at drilling permits,” Sourcewater CEO Josh Adler said. “We did a study on this and were shocked to discover that the average drilling permit in Texas is filed 16 days after the well has already been drilled. So if you’re in the business of trying to sell things to people who drill and you’re trying to figure out whom to sell to based on when those drilling permits come out, you’re not doing too good.

“Of course, a lot of business happens between companies that already have established relationships. But if you want to expand your business beyond the people you already know that tell you what they are going to do before they do it, your only option today is [to look at] drilling permits … and drilling permits are essentially useless.”

Sourcewater looks at new satellite imagery of the Permian Basin every five to seven days and sees it within 24 hours of the images being taken, basically reviewing activity that occurred yesterday. What are they looking for? Drilling pad construction. Most operators start construction of a drilling pad upward of three months prior to drilling, a full 12 weeks, give or take, before the rig arrives on site and well before the permit is filed.

They also look for frac pit construction and water levels. Again, pits are built and filled ahead of the job and, depending on the size of the pit, it could take several weeks to fill. In Texas permits are not required to construct a freshwater frac pit, so there is no permit trail to follow if a company is interested in collecting those data. Satellite imagery also can give the company a good idea about the amount of water in an individual pit, plus or minus 20%. All of these data get plugged into Sourcewater’s Oilfield WaterMap intelligence platform, a mapping and analysis tool that reveals water assets, development trends, market prices, business activity and ownership intelligence.

“It is useful for finding out where and how much water is available in an area,” Adler said. “We match those locations up with leases and owner records to see who owns that water, who we should contact to see if it is for sale or if it’s available, how much is there … and it all ties together in the same online platform where you can analyze all of this in relation to where the future drilling is happening.”

He continued, “What are the water production levels for the existing oil and gas wells in this area? How much produced water is coming out of the ground? Where are the disposals? How much disposal capacity is there? How much disposal capacity is coming based on the permits that have been filed but are still undrilled? How far are operators of these leases sending their water for disposal now? If they are sending it a long way that means they are probably paying a lot. So all of these data go into one geospatial mapping platform, and we put all of these analysis layers on it that allow you to make better decisions about how to plan your water infrastructure. Is there excess available infrastructure near your project? If you sell disposal or water, should you be investing in building more disposal or pipelines or capacity in a given area? Where are the best places to invest in that? Who are the operators that are going to need it? And how much would they probably be willing to pay? We are really creating a system to answer all these types of questions in one place.”

Sourcewater started about five years ago as a marketplace for water sourcing, recycling and disposal for the oil and gas industry—a place where operators could trade and reuse produced water and excess freshwater with each other, and where surface owners, treatment facility owners and disposal well owners could sell their excess capacity into the market. It was kind of like Expedia for water services.

In the last year, the company has added on to and repositioned itself as an oilfield water intelligence platform. Today, the water marketplace, which is getting close to 10,000 water and disposal for-sale listings in the Permian Basin alone, is a subcomponent of the overall oilfield water intelligence platform. “The value of the marketplace is that it feeds price and availability information and trends into our intelligence platform,” Adler said.

“We recently acquired Digital H2O, which was really the only other company in this space,” he continued. “What Digital H2O is known for is that they take the well reports from the state of Texas for commercial disposal wells and basically use those to visualize the logistics, flow and utilization relationship between every operator lease and every commercial disposal well in Texas. So you can see exactly which leases send water and how much to which disposal wells; the utilization levels at those disposal wells; and which leases send water to which disposals so disposal companies can see who is doing business with my competitors, how busy my competitors are, how much water is coming from these leases and where is it going. It’s a piece of the second Big Data contributor to our water intelligence platform, which is all kinds of government record datasets—the Texas Railroad Commission, Texas Water Development Board, drilling permits, producing well permits, initial production reports, flow rates from water wells, the water quality from the water wells, the surface water permits—there are just so many of these datasets.”

Sourcewater is looking to add a new suite of digital tools to its platform this year to help with the planning of water transfer projects and pipeline projects. The suite is designed to make it easy

for companies to optimize the route, pump sizing and pump placement for their water pipelines and transfer lines right on the map.

“There is a lot of overspending when it comes to pump capacity for moving water … and on power,” Adler said. “That doesn’t need to be wasted. So this set of water project planning tools on WaterMap will allow people that plan and move water to do it much more efficiently.”

The company is focused on the Permian Basin, both Texas and New Mexico, but has some coverage in North Dakota due to the Digital H2O acquisition. Spreading coverage to other basins is in the offing as well as increased use of satellite imagery, focusing on earlier detection of projects and higher resolution visuals to build a more accurate dataset.

Bubbling to the surface

Select Energy Services Inc. is a water management company that provides services throughout the life cycle of oilfield water, from sourcing to disposal. According to the company, its late 2017 merger with Rockwater Energy Services, a provider of water management solutions, positioned Select as a leader in the market, especially around North American shale.

The company’s technology slate includes its AquaView monitoring, automation and information platform; automated proportioning systems for dynamic and precise mixing of fresh and produced water; and chemical-add trailers that allow injection of a suite of chemicals during water transfer and water recycling. This suite of technologies and the associated information and data are managed and accessible through real-time customer portals on AquaView.com and SESTreatment.com. Select also offers a comprehensive package of frac water treatment services, and these service offerings and technologies continue to evolve as the company explores better, faster and more efficient ways to solve its clients’ water issues.

In addition to providing produced water treatment services for reuse in fracturing, Select provides chemical additives to enhance downstream properties.

“We address issues, such as wellbore and surface facility maintenance, by adding corrosion or scale inhibitors or biocides using our chemical-add trailers,” said Cindy Peña, senior scientist at Select Energy Services. “The SESTreatment.com platform is a solution for operators and frac providers to monitor additives and correlate chemical addition data with changes in well performance. As a premier in-basin manufacturer and distributor of production, completions and specialty chemicals, we have the expertise to properly analyze customer needs and apply the most effective chemical additives based on water quality.”

Peña continued, “We’ve also been exploring nano-bubble technologies. When larger microbubbles are applied to water, a milky froth results. With nano-bubbles—if they are true nano-bubbles—they’re so small that you can’t see them in the water, and the significantly smaller diameter bubbles remain suspended in the water much longer. If you had a cup of water with nano-bubbles in it, it would look like flat water, not club soda. The nano-bubble matrix in water is very stable, so you don’t lose a lot of these bubbles to the air. In fact, special lab equipment is required to measure the number and size of nano-bubbles.”

Peña also points out that specialty gases may be used to achieve specific water treatment goals such as enhanced oil separation.

“Our ultimate goal in injecting nano-bubbles is to extend the life of treated water quality. Nano-bubbles using air is a potential method to address oxygen demand-related issues in pits and large volumes of stored water. One limitation to conventional aeration is the time required to saturate the water with oxygen to meet the demand of the pit. This is especially true when waters are re-inoculated with contaminants that are hard to control post-treatment,” she said.

“Conventional aerated bubbles are larger and tend to come to the surface faster reducing the window of time for the oxygen to react with organic matter and sulfide contaminants. Nano bubbles, however, theoretically have the ability to stay in the water longer, thereby extending their reaction time. The end result may be higher quality water by meeting the oxygen demand more efficiently than with traditional aeration. Treating with nano-bubbles may not only increase the rate of cleanup but could also potentially reduce the amounts of air/oxygen and chemicals.”

Technologies for oilfield water treatment continue to evolve, and Select is keen to stay on the forefront of new developments. Oilfield water treatment often utilizes a number of technologies including gas flotation units for solids separation and walnut-shell filters for dispersed-oil removal. Select also uses water-clarifying chemistries to reduce turbidity and enhance frac-quality water. Aeration is commonly used with stored treated water to maintain the water quality. There is no silver bullet when it comes to water treatment, as every operator has unique requirements, so the team is constantly developing customized solutions for specific customer applications utilizing multiple technologies, rather than promoting any single type of treatment technology for every instance.

“Water recycling and reuse services are becoming more prevalent due to the growing produced water volumes, sensitivity toward subsurface disposal and increasing frac water requirements. Additionally, Select’s focus on monitoring and automation capabilities across its services provides the customer with additional visibility, controls and risk management protections, resulting in safer and more environmentally responsible management of produced water. Technology will continue to add critical value to produced water management,” Peña said.

石油圈

石油圈