On Wednesday, the Energy Information Administration (EIA) released its firstInternational Energy Outlook since September 2014.

Then, the downturn had just begun. OPEC’s pivotal meeting that year was still two months away, the massive contraction in the U.S. rig count had yet to occur, and the hundreds of thousands of layoffs the industry has experienced since then was in the future.

How things have changed.

Here are 5 key takeaways from the EIA’s new report:

1.Brent Rebound Forthcoming

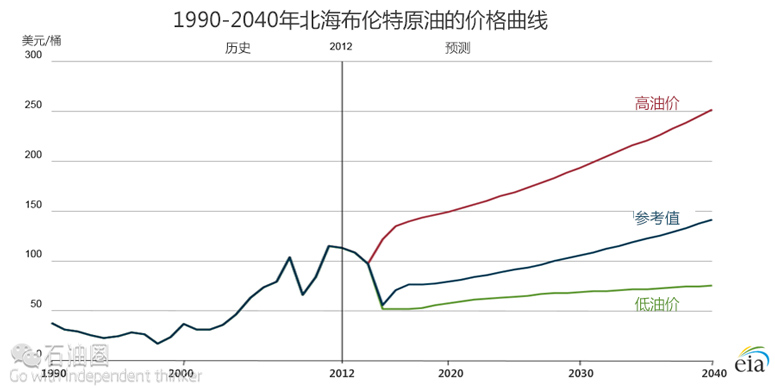

Brent should rebound next year to around $76/bbl, and continue an upward trajectory through the forecast period, the EIA said, as consumption continues to rise over the next three decades.

The new market conditions are assumed to continue in the IEO2016 Reference case, with the average Brent price dropping from $113/b in 2012 to $56/b in 2015, before increasing to $76/b in 2017. After 2017, growth in demand from non-OECD countries results in a return to higher world oil prices, and the Brent price rises to $141/b in 2040.

The agency also said it expects the WTI-Brent spread to remain between $0 and $10/bbl due to oversupply.

Amid this downturn, the EIA said investment “will likely to continue slowing to a point at which producers (outside of tight oil plays), which provide over 90% of world crude and lease condensate supply will be unable to respond quickly to future growth in demand for liquids.”

Consequently, the EIA expects oil prices to return to the $80/bbl range within the next decade. The report added, “If supply growth slows as a result of underinvestment, a sustained period of higher prices may be required to induce additional capital back into the market. Even then, long project timelines will delay the reentry of some production from noncontinuous resources into the market.”

2.NAM Production Has Added ~7 M/bpd To Global Market

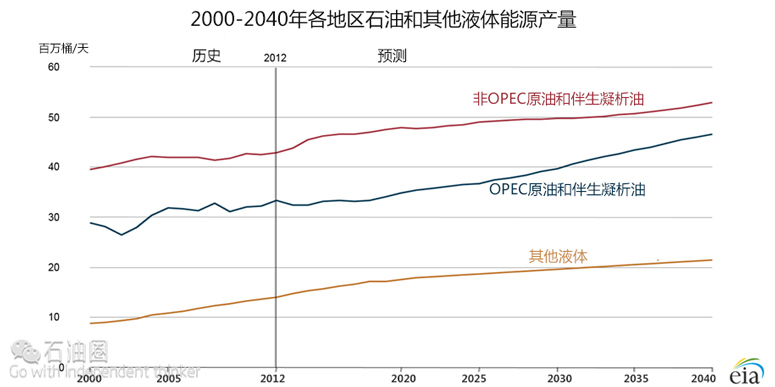

Growing supply in North America has yielded nearly 7 M/bpd of additional liquid fuels to the global market between 2008 and 2015. That rise has been only partially offset, the EIA says, by supply disruptions in other oil-producing regions, particularly in MENA.

3.Demand Rises

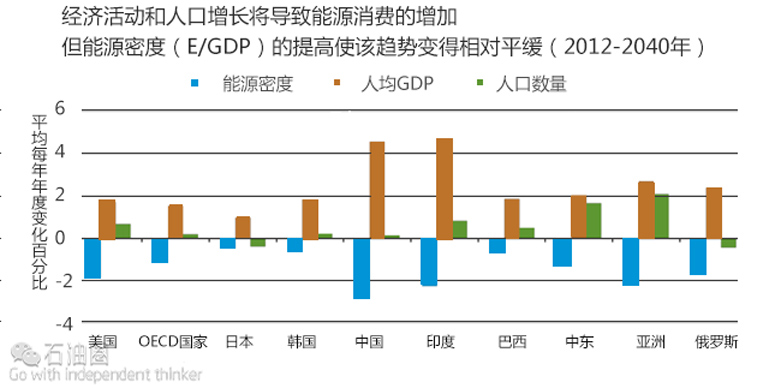

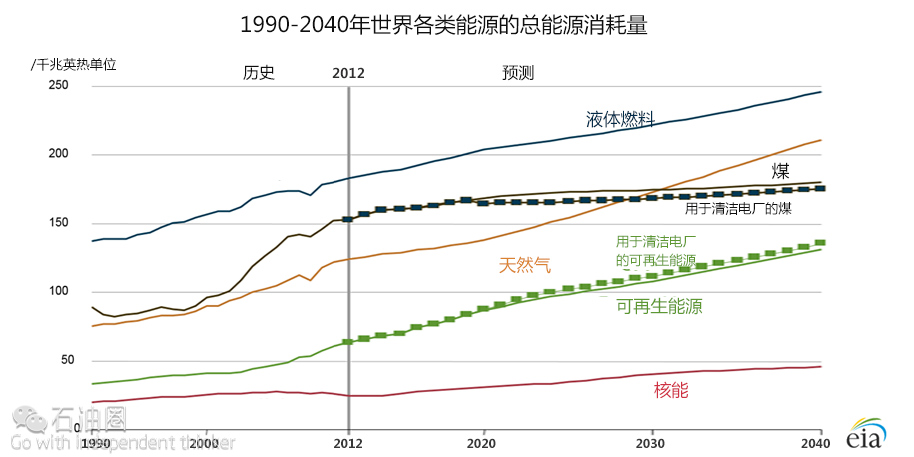

Non-Organization for Economic Cooperation and Development (OECD) countries in Asia, including China and India, will account for more than half of the total global increase in energy consumption over the EIA’s 2012 to 2040 forecast period.

Global use of petroleum and other liquid fuels is expected to increase from 90 M/bpd in 2012 to 100 M/bpd in 2020 and to 121 M/bpd in 2040. To satisfy the increase in world liquids demand in this scenario, liquids production increases by 30.5 M/bpd from 2012 to 2040.

4.Production Increasing

Starting in 2014, global production began exceeding consumption, reaching 95 M/bpd in 2015. This surplus went into storage, which increased OECD inventories to 2.7 billion barrels in the November 2015.

The EIA projects that OPEC will invest in incremental production capacity to maintain a 39%-43% market share of total world liquids production through 2040. This, the agency notes, is consistent with the group’s share over the past 15 years.

Increased OPEC production is seen to contribute 13.2 M/bpd to the total increase in global production. Crude oil and lease condensate supplies from non-OPEC countries add another 10.2 M/bpd. According to EIA estimates, over the past two years unplanned crude oil production outages- mainly in the Middle East and Africa- averaged 3.2 M/bpd, and amounted to 3.4 M/bpd in November 2015.

5.Qualifying The Outlook

Future supply disruptions are among the unpredictable variables with which the EIA qualifies its outlook.

Other factors include economic growth in key economies (mainly China, Russia and Brazil), the implementation and strength of climate policies, technology improvement rates, unrest in oil producing countries, OPEC production and the future of nuclear generating capacity.

石油圈

石油圈