Blowing The Permian Curve

The North American shale revolution is far from over. Having learned how to unlock commercial volumes of oil and gas from these ultratight formations, operators and service companies are now focused on the twin strategies of trimming drilling and completion costs and increasing production from each wellbore. And in recent years those efforts have been largely successful. According to a March 2016 U.S. Energy Information Administration (EIA) report, 2015 drilling and completion costs in five major U.S. onshore regions were “between 25% and 30% below their level in 2012, when costs were at their highest point over the past decade.”

Those savings are attributable in large part to the introduction of shale-specific technology. The use of bits and fluids designed specifically for drilling long sections of shale has lowered the cost of well construction at the same time that an explosion in available data from real-time downhole and surface sensors has enabled drillers to steer wellbores efficiently and precisely for optimal wellbore placement.

The key to further cost reductions lies in the development of more efficient hydraulic fracturing operations. According to the EIA study, which included wells drilled in the Bakken, Eagle Ford, Marcellus and Permian Basin, hydraulic fracturing and proppant together account for about 38% of total well costs.

Isolating fracturing treatments

Hydraulic fracturing accounts for such a large portion of overall well costs because of the time-intensive process of perforating horizontal shale wells in stages. Operators are continuously driven to find methods for reducing operational costs by increasing efficiency. Diversion, achieved chemically or mechanically, has been introduced to distribute treatment fluids uniformly over targeted intervals. Chemical diverters are temporary bridging agents made up of particulate materials that are water-insoluble and oil-soluble. The first documented use as a downhole seal was in 1930, and the chemistry behind diverter technologies has advanced significantly since.

In fracturing operations chemical diverters are run as pills after the flush to form plugs across perforations that isolate the treated zone and divert fracture fluids to untreated areas of the well. The pills are designed to degrade predictably with time and temperature through hydrolysis to allow the treated zone to flow unimpeded. Like mechanical methods such as a ball drop system, particulate diverters enhance the fracture network by forcing more perforations to take fluid and can eliminate plugs between stages and thus require no wireline or coiled tubing intervention. In contrast to ball drop systems, the seal formed by diverters is independent of pump pressure; if the pumps fail or are shut down, the seals remain in place in the perforation tunnels until it degrades.

Maximizing efficiency

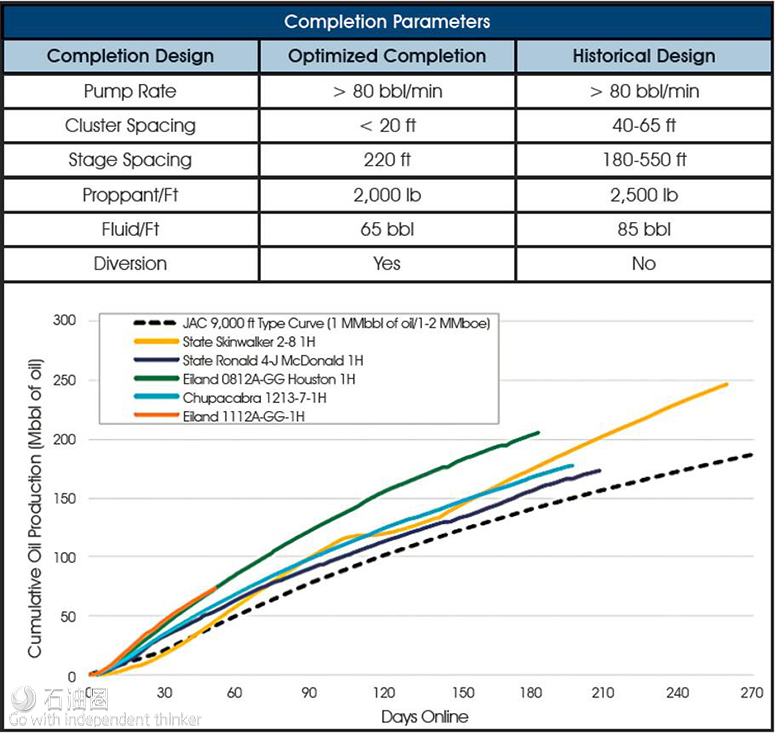

West Texas operator Jagged Peak Energy has worked to optimize its completions and maximize return on investment in the challenging Delaware Basin arena—specifically the southern region in Ward and Pecos counties. This area is known for its high treating pressures during hydraulic fracturing as well as many other intrinsic challenges. Slickwater designs incorporating large volumes of water and proppants have been deployed throughout the area. The operator’s historic completion designs placed large volumes of about 2,500 lb of proppant per perforated foot of lateral using upward of 85 bbl of fluid per foot to carry this proppant. West Texas wells often incorporate resin-coated proppant as a tail within each stage to aid in minimizing sand flowback post-completion. All of these factors impact economic feasibility of a play, and strategic improvements to proppant placement within targeted zones can positively impact well performance and the bottom line for the operator.

Jagged Peak developed an optimized completion design that incorporates chemical diversion as well as smaller stage size and an increased number of perforation clusters to more efficiently stimulate the formation. The aim of these process changes is to increase the intensity of the fractured interval and maximize stimulated reservoir volume (SRV) to increase potential EUR. The company contracted Keane Group, a hydraulic fracturing service provider experienced in the Wolfcamp and Bone Spring formations, to implement the design and provide a diverter customized to meet operational specifications.

When increasing the number of perforation clusters within a smaller stage, there are inherent issues with cluster inefficiency. An overabundance of holes reduces the flow rate per perforation and can leave many perforations under- or unstimulated. The diversion chemistry Jagged Peak selected for its completion design is designed to flow to the path of least resistance; it follows where the proppant has been going to seal off the flow and forces the fluid and proppant to an alternate path through other perforations. The result of using chemical diverters is that more perforations are stimulated and fracture intensity is improved. The net result is that more of the rock volume is stimulated and the surface area of the fracture network is maximized.

Jagged Peak’s optimized design is a next-generation step toward improved well performance. With shorter stages, increased perforation clusters and chemical diversion, the design with cluster stimulation has improved well performance of these optimized wells, which are outperforming the type curve by 35% based on EUR per 305 m (1,000 ft). The optimized design resulted in decreased pumping time per stage and improved efficiency by 22% for the Jagged Peak and Keane Group. By shaving hours off each stage, the improvement increased the number of stages per day completed by the crew.

As Keane’s ReDirect 3500 diverter technology is introduced in the West Texas market, more operators will benefit from not only the strong diverting capability but also the enhancements to near-wellbore conductivity and sand flowback control. Establishing a reliable control on proppant flowback will give operators like Jagged Peak an opportunity to further cut costs that might have been spent on resin-coated proppants previously, saving potentially $40,000 to $50,000 per well.

The application of diverters in West Texas has proven successful on numerous wells, so this method has a long-term place in Delaware and Permian Basin operations. Diverters provide myriad benefits, not the least of which is helping to mitigate long-term well maintenance issues by ensuring the sand stays where it is pumped into the formation and not back in the wellbore.

石油圈

石油圈