Paal Kibsgaard, Schlumberger Chairman and CEO, addressed investors on Monday March 21, 2016 at the Scotia Howard Weil 2016 Energy Conference in New Orleans.

Paal has been one of the most candid CEOs on the industry’s condition over the past 6-12 months. And this week was no different as he dubbed this the deepest industry financial crisis on record and said most oil service companies are now fighting to survive.

Over the next 7 slides are a selection of key takeaways from Kibsgaard’s presentation. The captions are direct quotes from the speech transcript. If you are short on time, focus on the first 4 slides – they are a must read for anyone working in O&G.

1. Most Service Companies Are Now Fighting For Survival

Assuming a 1% demand growth scenario, it first means that the ‘hold-your-breath’ approach of the oil and gas operators will be unable to deliver the required production growth.

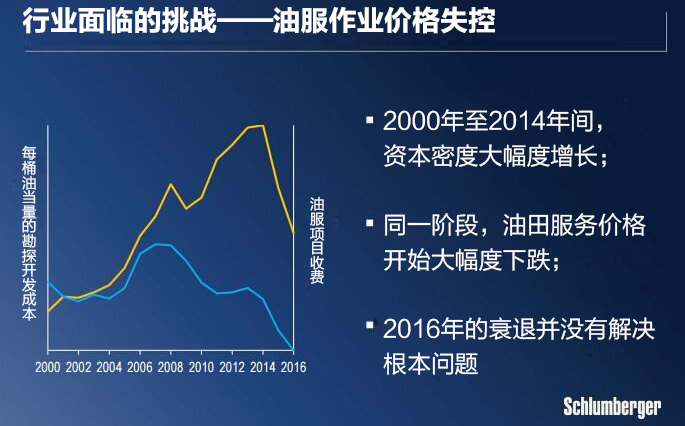

The apparent cost reductions seen by the operators over the past 18 months are not linked to a general improvement in efficiency in the service industry. They are simply a result of service-pricing concessions as activity levels have dropped by 40-50% and most service companies are now fighting for survival with both negative earnings and cash flow. The unsustainable financial situation of the service industry together with the massive capacity reductions mean that the cost savings from lower service pricing should largely be reversed when activity levels start picking up.

The fact remains that the industry’s technical and financial performance was already challenged with oil prices at $100 per barrel as seen by the fading cash flow and profitability of both the IOCs and independents in recent years. Over the past decade, our industry has simply not progressed sufficiently in terms of total system performance to enable cost-effective development of increasingly complex hydrocarbon resources. This can be seen by the escalating industry cost per barrel.

2. The Most Severe Phase Of The Downturn Is Now Underway

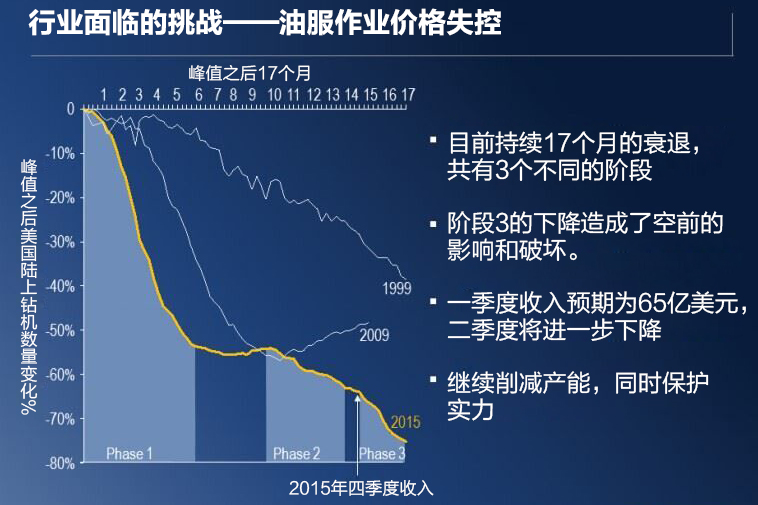

The current downturn has now persisted for 17 months since the US land rig count peaked in October of 2014. Using this rig count as a proxy, we have seen three distinct phases as the downturn has deepened. The third and most severe phase is taking place within this current quarter with the global activity impact and rate of disruption reaching unprecedented levels, showing an industry in a full-scale cash crisis.

So far, we have successfully managed the challenging commercial landscape of this downturn by balancing margins and market share and by aggressively reducing our global capacity. In parallel, we have steadily improved our intrinsic performance through our ongoing transformation program and this has enabled us to protect our financial strength.

However, the third phase of E&P spending reductions that we are currently experiencing will have a significant impact on our earnings per share in the current and coming quarters given the magnitude and erratic nature of the activity disruptions. As an indication of the impact, we now expect our revenue to come in around $6.5 billion in the first quarter, which is a drop of more than 15% sequentially, and with the outlook suggesting a further weakening in the second quarter.

Going forward, we will continue to tailor cost and resource levels to activity in order to protect our financial strength.

3. The Old ‘Hold-Your-Breath-And-Hope-For-Better-Times-Soon’ Approach Won’t Work This Time

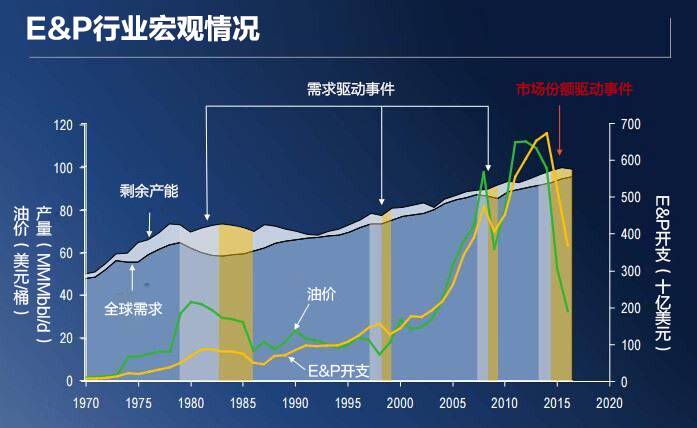

This ‘hold-your-breath and-hope-for better-times-soon’ playbook has in the past allowed the industry to live through shorter-term demand downturns while waiting for business to return to normal. The major difference in the current industry situation is that we are unlikely to see oil prices returning to the $100 level because this downturn is not driven by lower demand or by external factors. It is instead an immediate result of OPEC’s decision to protect market share rather than oil price which clearly demonstrates that they still have a firm grip on the global E&P industry.

This shift is likely to have deep and long-term consequences for the industry similar to how limited access to reserves in the 1990s drove international and independent oil companies to pursue unconventional and deepwater resources. It is also similar to how high oil prices over the past decade created a surge in investment and production from these higher-cost resources even though the underlying progress in project performance was insufficient.

Going forward, the industry is likely facing a ’medium-for-longer’ oil price scenario, subject to periods of volatility, as the national oil companies within OPEC can still generate significant returns for their owners in such an environment due to the low cost base of their conventional resources.

4. Activation Of Traditional E&P Downturn Playbook Created A Dramatic Situation For Oil Service

Today the E&P industry finds itself in the deepest financial crisis on record, with profitability and cash flow at unsustainable levels for most oil and gas operators which in turn has created an equally dramatic situation for the service industry.

In spite of the unique structural nature of this downturn, oil and gas operators have once again activated the traditional playbook they have used to navigate every industry downturn since the 1970s. This dictates halting investments in exploration, aggressively curtailing development activity, and relentlessly squeezing service industry prices.

5. Fragility Of E&P Customer Base Means No Oil Service Improvement This Year

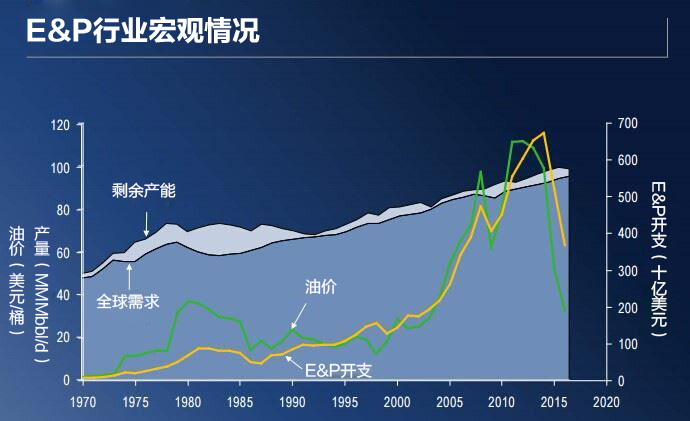

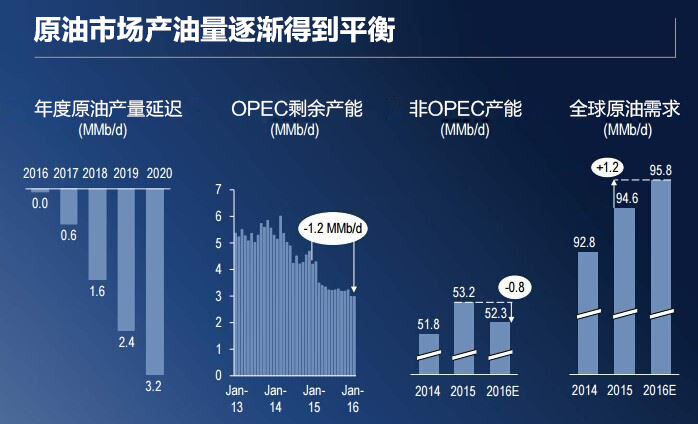

Looking at the macro picture, the physical balances in the oil market continue to tighten with OPEC production outside Iran now appearing to stabilize and with decline accelerating in non-OPEC production.

On the other hand the IEA global oil demand forecast was recently revised upwards and 2016 growth now stands at 1.2 million barrels per day. The latest data points have, in recent weeks, sent the oil price up towards $40 per barrel and we would expect the upward trend to continue as the physical balances tighten further in the coming quarters.

In spite of this, we maintain our view that there will be a noticeable lag between higher oil prices and higher E&P investments given the fragile financial state of our customer base, which means that there will be no meaningful improvement in our activity until 2017.

6. The Existing Commercial Model In Upstream Must Be Modified

We firmly believe that the combined capabilities of the E&P operators and the leading service companies have the potential to realize the required performance upside for the industry. Still, this requires a willingness to modify the existing commercial model because the procurement-driven contracting model of the late 1990s is today the main obstacle to create the needed performance progress.

In the procurement-driven approach, all aspects of project scope selection and technical design for new hydrocarbon developments are done by the technical teams of the operators. The work scope is then fragmented into a myriad of small parts and subsequently put out for bid by the procurement organization, seeking the lowest price for each element and expecting that this will bring both the lowest project cost and the highest project value.

7. Looking For Hope In A Medium-For-Longer Scenario

Still, in the midst of this unprecedented industry downturn, there are several positive elements of the scenario that make me optimistic and confident about the medium-term outlook for Schlumberger.

First, the magnitude of the ongoing E&P investment cuts is now so severe that it can only accelerate production decline and upward movement in the price of oil with a growing chance that we will be facing an upside spike in prices.

Second, our underlying cash flow is still solid, and with more than $10 billion of cash and short-term investments on the balance sheet after the close of the Cameron deal we can operate in this environment longer than most.

Third, while we have reduced capacity significantly we have still safeguarded the core expertise and capabilities of the company above the current market needs. This, combined with the strategic moves we have made during the downturn, leaves us very well positioned as the industry starts to transform.

And fourth, with the massive capacity reductions undertaken by the entire service industry we are optimistic that we can restore a good part of the temporary international pricing concessions we have made as oil prices and activity levels start to normalize.

In closing we firmly believe in a medium-for-longer oil price environment where there is an urgent need for the industry to move to a contracting model with significantly more collaboration and commercial alignment between operators and leading service companies.

石油圈

石油圈