Iraq’s 2017 target for oil expansion within reach, Wood Mac says

Iraq’s ambition to boost oil-output capacity to a record 5 MMbpd is “not unrealistic” as the country prepares for the end of OPEC-mandated supply limits, consultants Wood Mackenzie Ltd. said.

Iraq, which has been rehabilitating its oil industry after years of conflict, has vowed to keep expanding capacity while respecting an Organization of Petroleum Exporting Countries’ accord that will limit its production until next April. The country wants to be ready for either the end of that deal, or to press its OPEC partners for some leeway if the group chooses to further prolong output curbs, Edinburgh-based Wood Mackenzie said.

OPEC’s second-biggest producer reluctantly agreed in November to participate in production cuts to end a global oil glut, arguing it deserved to be exempt while reviving its economy and battling Islamist insurgents. Iraq also hesitated before backing a nine-month extension of the accord finalized on May 25, and has only made about half its pledged output curbs this year, according to the International Energy Agency.

“From a production capacity point of view, the investment in a few of the southern fields is taking them closer to that number,” Ian Thom, principal upstream analyst at Wood Mackenzie, said in an interview. “They may be thinking ahead to the end of the nine-month period, when if they can demonstrate capacity of 5 MMbbl, it may make for a different conversation with OPEC members.”

Saudi Arabia, OPEC’s biggest member, has signaled the group is prepared for even longer output curbs if the current measures fail to reduce the world’s bloated fuel inventories.

Output hurdles

Iraq pumped about 4.6 MMbpd in December, just before the OPEC-mandated cuts took effect, according to data compiled by Bloomberg. The development of the West Qurna-1, Halfaya and Zubair oilfields could take Iraq “a long way towards that number” of 5 MMbbl, Thom said.

Getting beyond the 5-MMbbl level may prove more challenging, according to Wood Mackenzie. A range of obstacles is checking Iraq’s potential, from limited water supply for injection to maintain reservoir pressure to the “very tough” contractual terms that discourage companies from investing, Thom said. While there’s a program to drill 30 wells at Majnoon field, bottlenecks in oil treatment facilities will hinder growth, he said.

Iraq is new oil king, beats Saudis in fastest growing market

Iraq is gaining the edge over Saudi Arabia in the world’s fastest-growing oil consumer amid an intensifying race among producers to retain their most-prized markets.

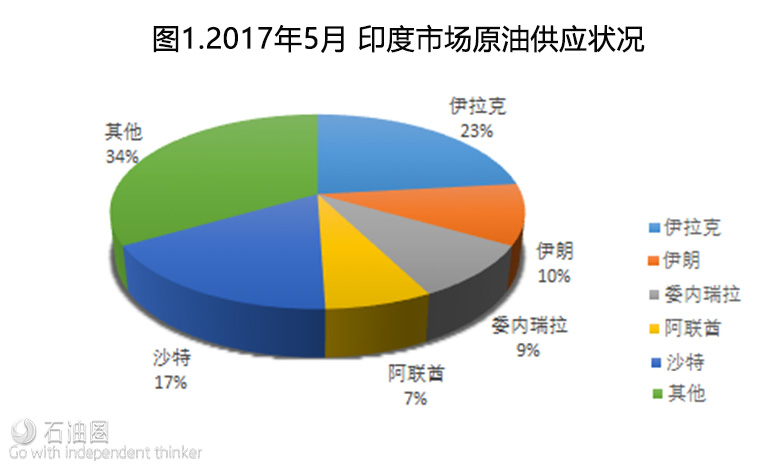

Iraq was the top crude supplier to India for a third month in May, shipping 1 MMbpd, according to shipping data compiled by Bloomberg. Iraqi supplies accounted for 23% of India’s purchases last month, up from an average 19% in the previous four months, while Saudi Arabia’s share fell by 1% to 17%, the data showed.

Oil producers are facing increasing competition in major markets like China and India as OPEC and its partners continue efforts to curb output to clear a global glut. India’s $2-trillion economy imports more than 80% of its crude requirement and the IEA expects it to be the fastest-growing consumer through 2040.

“Saudis used to be the king when it comes to crude supply, but now it’s becoming a prince,” said R. Ramachandran, the head of refineries at Bharat Petroleum, India’s second-biggest state-run refiner. “Preference for Iraqi crude will continue as Indian refiners continue with refinery upgrades.”

Iraq, which had been the No. 2 seller to India for years, was able to overtake the Saudis as Indian refiners have implemented plant upgrades over the past couple of years, enabling them to process crude with a higher sulfur content.

The Middle East nation has also improved its port infrastructure to ensure a stable supply. Iraqi crude used to be less preferred due to delays and inconsistencies in shipments as the Gulf nation lacked the required port infrastructure, according to Ramachandran.

“Iraqi crude is getting attractive and it suits our refineries very well,” said Mukesh Kumar Surana, chairman of Hindustan Petroleum. “Iraq has come out of the supply uncertainties and the pricing is very competitive.”

Indian Oil

The state refiner buys about 4 million tons of Iraqi grades annually on a term basis, which matches the volume it gets from Saudis. Indian Oil Corp., the nation’s biggest processor, will boost Iraqi imports to about 18 million tons in 2017 under term contracts from 15.6 million last year, said Finance Director Arun Kumar Sharma. Saudi purchases will remain steady at 5.6 million tons.

India’s total crude imports in May remained flat from April at 4.35 MMbpd, according to the shipping data. Iraqi supplies fell 11% last month from 1.14 MMbpd in April, the highest this year.

Iraq, the OPEC member which is among the most closely watched nations for compliance to the group’s curbs, exported 3.93 MMbpd in May, the highest in 2017, according to vessel tracking and shipping agent data gathered by Bloomberg.

石油圈

石油圈