Upstream technology has advanced at an incredible pace over the past 5 years. Although new reservoirs are becoming more challenging and remote, production is growing like never before, particularly in North America (NAM). It seems that at least once a day, another media outlet reports that “US Production Hits 20 Year High” or “New US Oil Challenges Middle East” or “North America Flooded with Oil”.

So what technology will be the next big thing? The big four service companies alone spend about $2.5bn per year researching and developing new oilfield methodologies. And the O&G industry innovates at a more rapid pace than any other physical business on the planet. In the slides ahead, we’ll explore 10 cutting edge technologies (both onshore and offshore) that you will likely hear much more about in 2014 and beyond. Some have been around for a while but are poised to take off soon because of industry trends. Others are being proven/tested right now.

1.Arctic Solutions – Sub-zero Innovation

E&P activity is on the rise in arctic areas such as Russia, the Caspian Sea, the North Sea, Canada and Alaska, where more than 400 undiscovered oil and gas fields are estimated to exist. There are many operational and environmental concerns when it comes to operating in sub-zero temps, and these require the re-design of most standard oilfield equipment. For example, metals without adequate impact toughness exhibit failure tendencies due to brittleness when exposed to arctic conditions. Tenaris is an example of a company creating industry solutions for arctic operations. Tenaris offers a sub-zero dopeless solution which employs a dry-coating method. With this product, pipe can be transported, stored, handled, and run normally without the need for a constant heat source to warm the running compound (this reduces transport loads). Tenaris also offers arctic connection solutions and low temperature grades with better ductility and fracture toughness. Operators will push deeper into the arctic over the next several years, and innovative companies like Tenaris will supply this thrust.

2.Hydrate Remediation Demand to Grow Alongside Deepwater Development

New hydrate remediation methods are a hot topic in deepwater development and will become an even bigger topic as the deepwater cycle matures from exploration to development over the next five to ten years. Chemical and mechanical methods haven’t yet proven very effective. Electro-heating is controversial, and it can damage pipe. Hydrate formation can have topside implications. Too often, deepwater project teams don’t worry about hydrate formation until it becomes a problem.Oceaneering is a leader in hydrate remediation services, and their engineering teams are working on new solutions. Shown above is the company’s tried-and-true skid-based remediation tool, which is designed to be used in the event of a hydrate plug. The skid is deployable from a MSV, and is operated solely by an ROV. The skid has the capability to depressurize the production piping to 100 psig or less under 8,000 ft. of water. Methanol can be routed through the production piping in either direction.

3.Bi-fuel Power Sources Gain Favor with Operators

A new technology trend we expect to gain a lot of traction over the next couple years is the adoption of bi-fuel power sources for land drilling and completion equipment. Patterson and Baker Hughes are leading the charge on this front, and operators enjoy lower fuel costs, more environmentally friendly ops, prevalent access to line gas in the field, and less downtime. This Patterson slide shows one of their frac trucks with a natural gas-ready engine on board. Patterson has completed more than 400 stages using nat gas as a fuel source. This replaced more than 112,000 gallons of diesel with clean burning gas and cut 800,000 pounds of transportation loads on local roads.

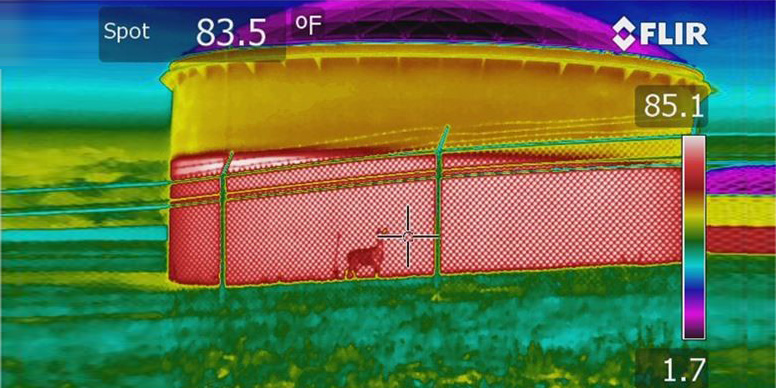

4.Thermal/Infrared Imaging: Proactively Addressing Infrastructure Weak Spots

Leaking storage tanks, whether above or below ground, can pollute the environment, threaten public health, and lead to billions of dollars in direct and indirect costs. One main reason for storage tank failure is corrosion. Fortunately, corrosion prevention technology exists which can protect storage tanks and keep them structurally sound for years to come. Thermal/infrared imaging technology can be used to point out areas of concern before the point of concern is entirely corroded. As oilfield infrastructure in NAM expands and ages, we see thermal imaging playing an increasingly important role in identifying weak spots before they become real (and costly) problems. Oilpro member Sammy Sahagian, who runs an infrared imaging company, says that many O&G companies are still being educated on the value proposition of this technology. We’re betting demand for this service grows quite a bit over the next couple of years.

5.Breathing New Life Into Mature Fields

As global oilfields age, new technologies are renewing production in old fields. This is a rapidly growing market and a hotbed for oilfield innovation. For perspective, Wood Mackenzie estimates that mature fields will account for over 70% of global production by 2018, up from about 65% in 2008. While there are many technologies worth highlighting when it comes to the mature field treadmill, we find 4D seismic particularly interesting. This technology is changing the game in the North Sea by allowing operators to identify pockets of oil that were missed as giant fields were drained over the past several decades. Essentially, 4D time lapse imaging allows operators to understand how older fields have flowed, helping to identify pockets of trapped hydrocarbon—very useful in a mature area like the UKCS. Broader adoption of 4D will require better repeatability and integration with other mature field solutions, but there is no denying the value of the “vision” 4D provides.

6.Still Perfecting the Blowout Preventer

Since Macondo, operators, drilling contractors, and equipment providers have all focused on making BOP stacks more effective. In the latest instance of this, Transocean recently announced a partnership with Shell to re-engineer their BOP control systems. BOPs have caused about half the downtime Transocean experienced in their offshore drilling rig fleet this year. Control system reliability is a frequent cause of this downtime. This Shell/Transocean partnership is a case of large operator and contractor working together to advance technology for the betterment of industry. While its a long-term project (three years), we expect the innovation that arises from this endeavor will push BOP technology to the next level and reduce downtime across Transocean’s fleet.

7.Integrated Drilling and Completion Systems

A long-term trend underway in oilfield services is companies transitioning from niche specialties to integrated oilfield and downhole solutions. This coincides nicely with the transition in NAM from exploration mode to exploitation mode. Before, availability of equipment was all important. Now, packaged systems and solutions are en vogue. This is a key differentiator for the big service firms that can make the leap and integrate multiple technologies and products into “smart” packages. The latest push forward along this path comes from Halliburton, in the form of their new CYPHER product. The service is supported by a breakthrough technology suite using an iterative process that identifies the best well stimulation and placement designs, critical parameters to the total well cost and ultimate production.

8.OneSubsea Redefining Subsea Product Development

While it’s still early days for the OneSubsea JV (the first combination of a subsea equipment provider with a service/reservoir optimization group), we believe the products it develops over the next couple of years have the potential to change how operators think about subsea. The company is making significant R&D investments in 2014 across a host of new product development opportunities that are resulting from the combination of Cameron’s and Schlumberger’s deepwater capabilities. What’s new is the marriage of deep reservoir knowledge with subsea technology to maximize operators’ reservoir recovery over the entire life of a field. The combination of surface, subsea, and subsurface expertise should create a hotbed for innovation. We are excited to see what the JV will come up with over the next 24-36 months.

9.Automation: Plenty of Progress, Plenty of Running Room

From the driller’s cabin to the pipe-assembly floor, automation is changing the way drillers go about their business. While people will always remain in the loop, the uptake of new automation technology (such as National Oilwell’s NOVOS system highlighted above) is improving safety and efficiency across the oilfield. And its not just happening in drilling. Automation is a focus for operators in all physical aspects of the exploration and production process. Benefits include lower accident rates, better employee retention, and earlier first production. The last 5 years have seen a great deal of new automation initiatives, and the next 5 are likely to see even more.

10.New Generation Land Rigs Replace Old Models

Helmerich & Payne has long been the leader in building new generation land rigs. But now the entire industry is constructing new land drilling technology to keep up with the trends of efficiency and pad drilling. From Nabor’s Pace-X unit to Patterson’s APEX walking rig and HP’s FlexRig, the old fleet is being replaced with new gen models that keep getting better, faster, and more mobile. This trend has been underway since 2006, and, by 2016, we expect the vast majority of land rigs working in NAM to be of late-model designs.

石油圈

石油圈