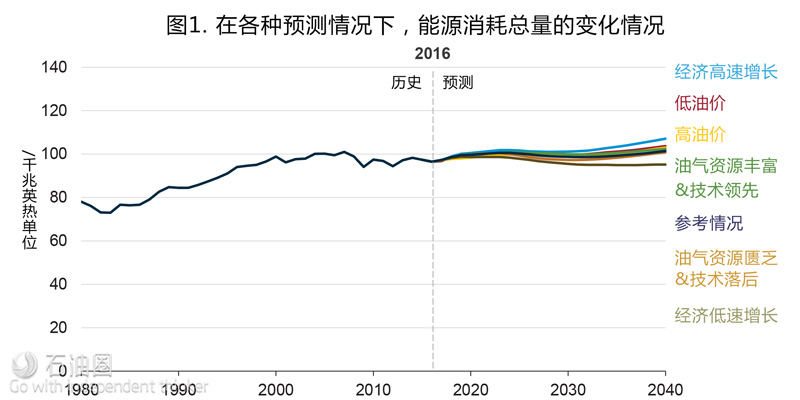

Energy consumption varies minimally across all AEO cases—bounded by the High and Low Economic Growth cases.

• In the Reference case, total energy consumption increases by 5% between 2016 and 2040.

• Because a significant portion of energy consumption is related to economic activity, energy consumption is projected to increase by approximately 11% in the High Economic Growth case and to remain nearly flat in the Low Economic Growth case.

• Although the Oil and Gas Resource and Technology cases affect the production of energy, the impact on domestic energy consumption is less significant.

•In all AEO cases, the electric power sector remains the largest consumer of primary energy.

•Projections of total energy consumption (and supply) are sensitive to the conversions used to represent the primary energy content of noncombustible energy resources. AEO2017 uses fossil-equivalence to represent the energy content of renewable fuels.

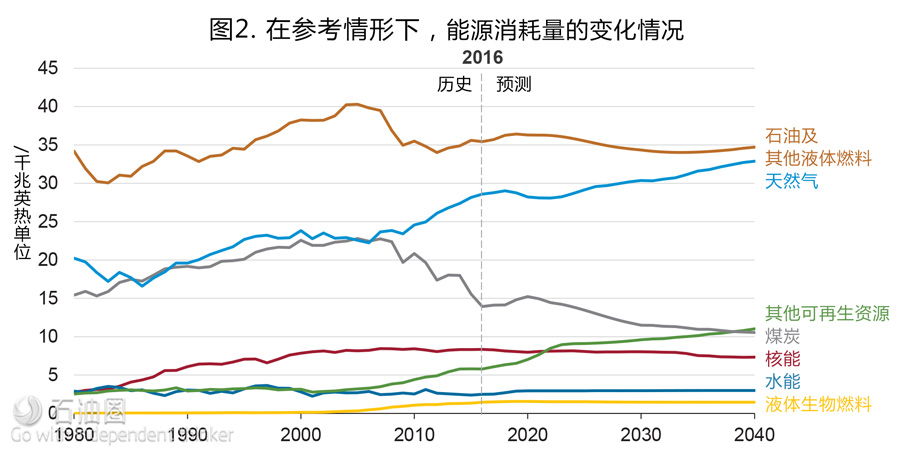

Domestic energy consumption remains relatively flat in the Reference case— —but the fuel mix changes significantly 。

• Overall U.S. energy consumption remains relatively flat in the Reference case, rising 5% from the 2016 level by 2040 and somewhat close to its previous peak. Varying assumptions about economic growth rates or energy prices considered in the AEO2017 side cases affect projected consumption.

• Natural gas use increases more than other fuel sources in terms of quantity of energy consumed, led by demand from the industrial and electric power sectors.

• Petroleum consumption remains relatively flat as increases in energy efficiency offset growth in the transportation and industrial activity measures.

• Coal consumption decreases as coal loses market share to natural gas and renewable generation in the electric power sector 。

• On a percentage basis, renewable energy grows the fastest because capital costs fall with increased penetration and because current state and federal policies encourage its use.

• Liquid biofuels growth is constrained by relatively flat transportation energy use and blending limitations 。

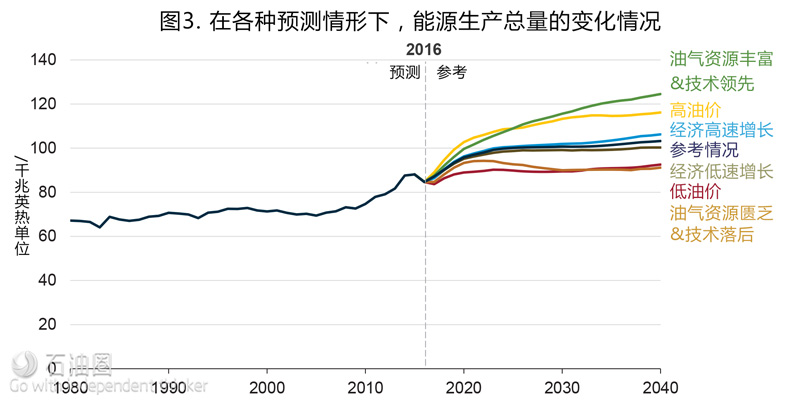

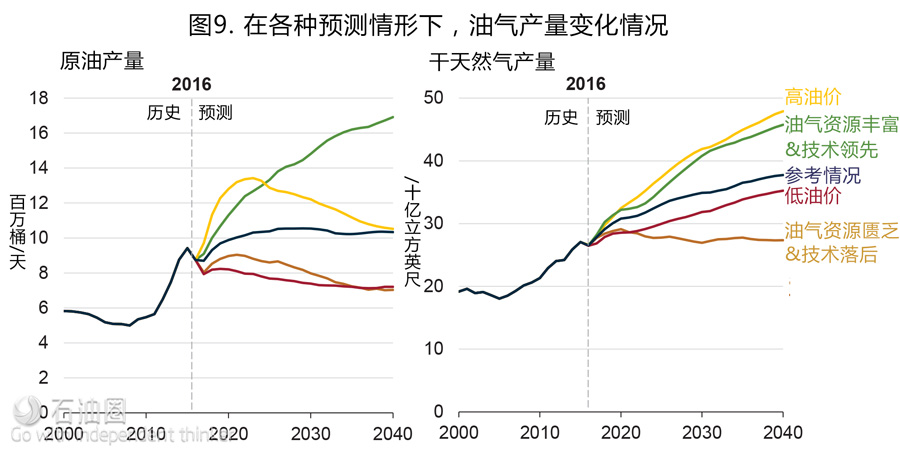

Energy production ranges from nearly flat in the Low Oil and Gas Resource and Technology case—to continued growth in the High Resource and Technology case 。

• Unlike energy consumption, which varies less across AEO2017 cases, projections of energy production

vary widely.

• Total energy production increases by more than 20% from 2016 through 2040 in the Reference case, led by increases in renewables, natural gas, and crude oil production.

• Production growth is dependent on technology, resources, and market conditions.

• The High Oil and Gas Resource and Technology case assumes higher estimates of unproved Alaska resources; offshore Lower 48 resources; and onshore Lower 48 tight oil, tight gas, and shale gas resources than in the Reference case. This case also assumes lower costs of producing these resources.

The Low Oil and Gas Resource and Technology case assumes the opposite.

• The High Oil Price case illustrates the impact of higher world demand for petroleum products, lower Organization of the Petroleum Exporting Countries (OPEC) upstream investment, and higher non-OPEC exploration and development costs. The Low Oil Price case assumes the opposite.

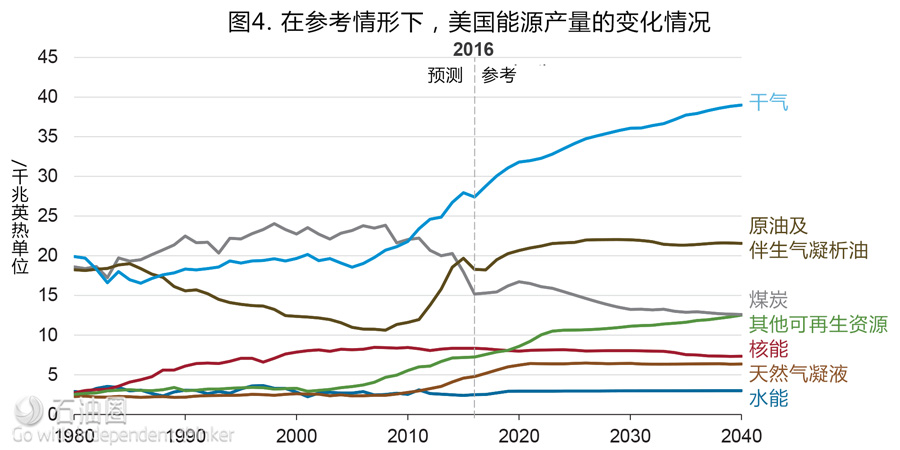

U.S. energy production continues to increase in the Reference case— led by growth in natural gas and renewables 。

• Natural gas production accounts for nearly 40% of U.S. energy production by 2040 in the Reference case. Varying assumptions about resources, technology, and prices in alternative cases significantly affect the projection for U.S. production.

• Crude oil production in the Reference case increases from current levels, then levels off around 2025 as tight oil development moves into less productive areas. Like natural gas, projected crude oil production varies considerably with assumptions about resources and technology.

• Coal production trends in the Reference case reflect the domestic regulatory environment, including the implementation of the Clean Power Plan, and export market constraints.

• Nonhydroelectric renewable energy production grows, reflecting cost reductions and existing policies at

the federal and state level that promote the use of wind and solar energy 。

• Nuclear generation declines modestly over 2017–40 in the Reference case as new builds already being developed and plant uprates nearly offset retirements. The decline in nuclear generation accelerates beyond 2040 as a significant share of existing plants is assumed to be retired at age 60.

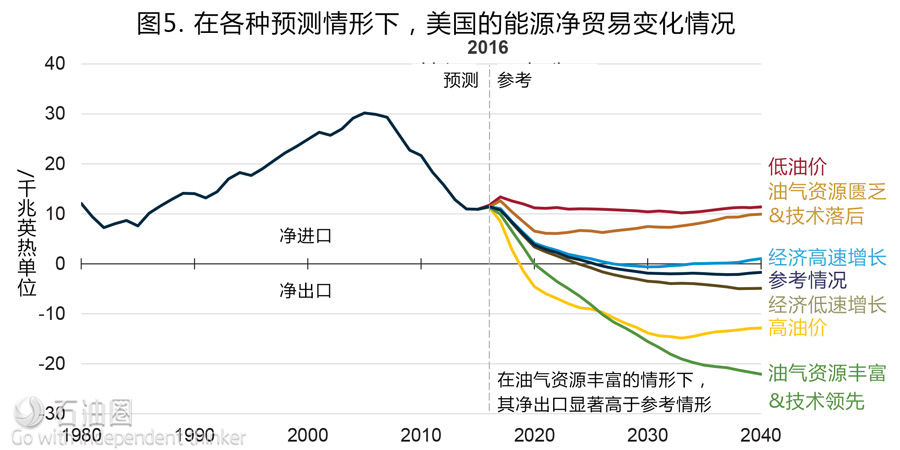

The United States becomes a net energy exporter in most cases— and under high resource and technology assumptions, net exports are significantly higher than in the Reference case .

• The United States is projected to become a net energy exporter by 2026 in the Reference case projections, but the transition occurs earlier in three of the AEO2017 side cases.

• Net exports are highest in the High Oil and Gas Resource and Technology case as favorable geology and technological developments combine to produce oil and natural gas at lower prices 。

• The High Oil Price case includes favorable economic conditions for producers, but consumption is lower in response to higher prices. Without substantial improvements in technology and more favorable resource availability, U.S. energy production declines in the 2030s.

• In the Low Oil Price and Low Oil and Gas Resource and Technology cases, the United States remains a net importer over the analysis period.

• In the Low Oil and Gas Resource and Technology case, the conditions are unfavorable for U.S. crude oil production at levels that support exports.

• In the Low Oil Price case, prices are too low to provide a strong incentive for high U.S. production.

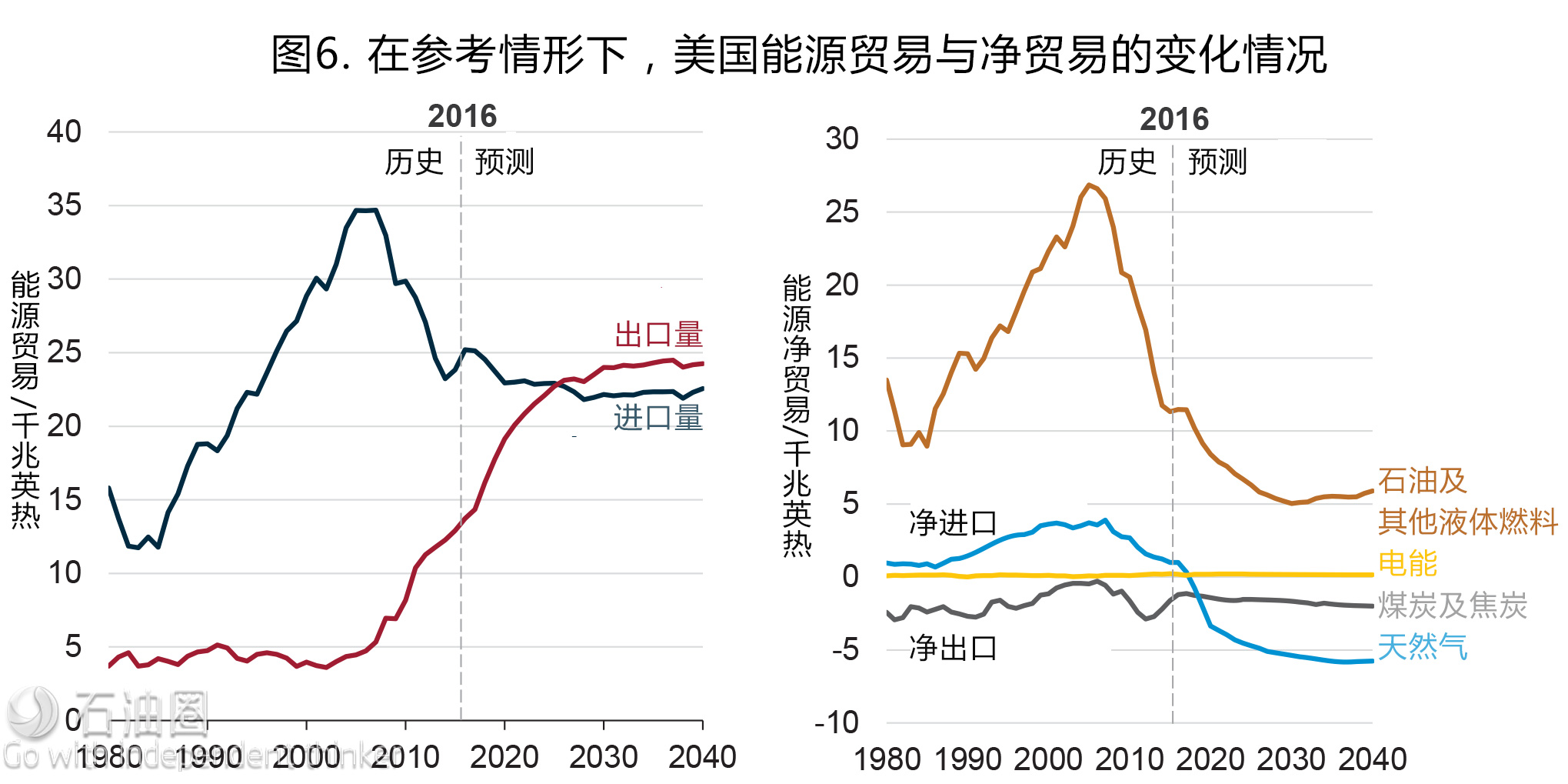

The United States becomes a net energy exporter in the Reference case —as natural gas exports increase and net petroleum imports decrease 。

• The United States has been a net energy importer since 1953, but declining energy imports and growing energy exports make the United States a net energy exporter by 2026 in the Reference case projection.

• Crude oil and petroleum products dominate U.S. energy trade. The United States is both an importer and exporter of petroleum liquids, importing mostly crude oil and exporting mostly petroleum products such as gasoline and diesel throughout the Reference case projection.

• Natural gas trade, which has historically been mostly shipments by pipeline from Canada and to Mexico, is projected to be increasingly dominated by liquefied natural gas exports to more distant destinations.

• The United States continues to be a net exporter of coal (including coal coke), but its exports growth is not expected to increase significantly because of competition from other global suppliers closer to major markets.

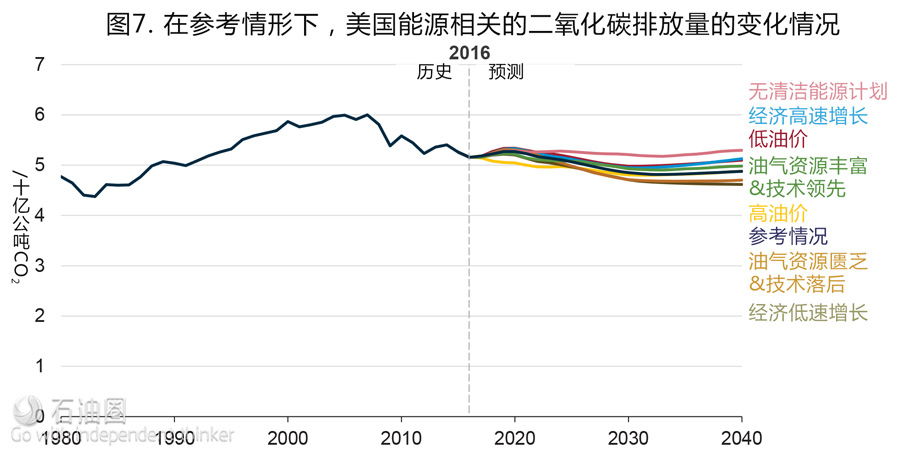

Energy-related carbon dioxide emissions decline in most AEO cases —with the highest emissions projected in the No Clean Power Plan case 。

• The electric power sector accounted for about 40% of the U.S. total energy-related carbon dioxide (CO2) emissions in 2011, with a declining share in recent years.

• The Clean Power Plan (CPP), which is currently stayed pending judicial review, requires states to develop plans to reduce CO2 emissions from existing generating units that use fossil fuels.

• Combined with lower natural gas prices and the extension of renewable tax credits, the CPP accelerates a shift toward less carbon-intensive electricity generation.

• The Reference case includes the CPP and assumes that states select the mass-based limits on CO2 emissions. An alternative case in AEO2017 assumes that the CPP is not implemented.

• AEO2016 included extensive analysis of the CPP and presented several side cases that examined various compliance options available to states.

Reference case energy-related carbon dioxide emissions fal-but at a slower rate than in the recent past

•From 2005 to 2016, energy-related carbon dioxide (CO2) emissions fell at an average annual rate of 1.4%. From 2016 to 2040, energy-related CO2 emissions fall 0.2% annually in the Reference case.

•In the industrial sector, growth in domestic industries, such as bulk chemicals, leads to higher energy consumption and emissions.

•In the electric power sector, coal-fired plants are replaced primarily with new natural gas, solar, and wind capacity, which reduces electricity-related CO2 emissions.

•Direct emissions in the residential and commercial building sectors are largely from space heating, water heating, and cooking equipment. The CO2 emissions associated with the use of electricity in these sectors exceed the direct emissions from these sectors.

•Energy-related CO2 emissions from the transportation sector surpassed those from the electric power sector in 2016. Transportation CO2 emissions remain relatively flat after 2030 as consumption and the carbon intensity of transportation fuels stay relatively constant.

Although population and economic output per capita are assumed to continue rising—energy intensity and carbon intensity are projected to continue falling in the Reference case

•In the United States, the amount of energy used per unit of economic growth (energy intensity) has declined steadily for many years, while the amount of CO2 emissions associated with energy consumption (carbon intensity) has generally declined since 2008.

•These trends are projected to continue as energy efficiency, fuel economy improvements, and structural changes in the economy all lower energy intensity.

•Carbon intensity declines largely as a result of changes in the U.S. energy mix that reduce the consumption of carbon-intensive fuels and increase the use of low-or no-carbon fuels.

•By 2040, energy intensity and carbon intensity are 37% and 10% lower than their respective 2016 values in the Reference case, which assumes only the laws and regulations currently in place.

Different macroeconomic assumptions address the energy implications of the uncertaintysurrounding future economic trends

•The Reference, High Economic Growth, and Low Economic Growth cases illustrate three possible paths for U.S. economic growth. The High Economic Growth case assumes higher annual growth and lower annual inflation rates (2.6% and 1.9%, respectively) than in the Reference case (2.2% and 2.1%, respectively), while the Low Economic Growth case assumes lower growth and higher inflation rates (1.6% and 3.2%, respectively).

•In general, higher economic growth (as measured by gross domestic product) leads to greater investment, increased consumption of goods and services, more trade, and greater energy consumption.

•Differences among the cases reflect different expectations for growth in population, labor force, capital stock, and productivity. These changes affect growth rates in household formation, industrial activity, and amounts of travel, as well as investment decisions for energy production.

•All three cases assume smooth economic growth and do not anticipate business cycles or large economic shocks.

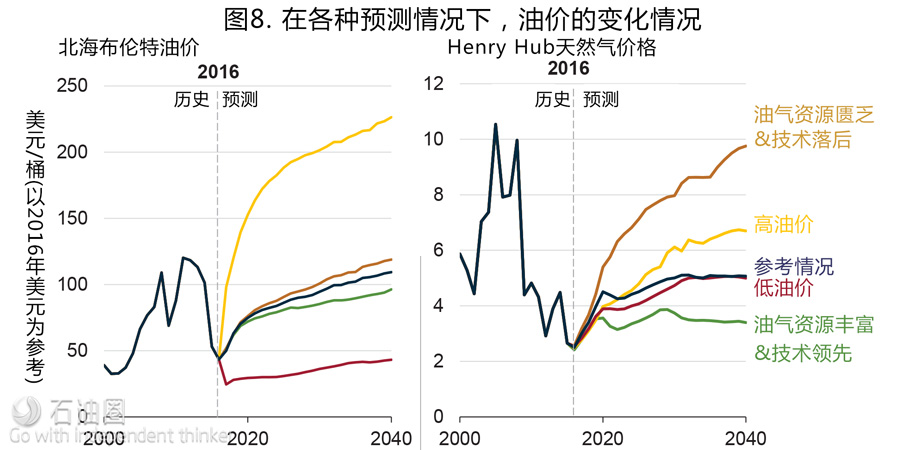

Reference case oil prices rise from current levels while natural gas price paths in the side cases are very different from those in the Reference case

•In real terms, crude oil prices in 2016 (based on the global benchmark North Sea Brent) were at their lowest levels since 2004, and natural gas prices (based on the domestic benchmark Henry Hub) were the lowest since prior to 1990. Both prices are projected to increase over the projection period.

•Crude oil prices in the Reference case are projected to rise at a faster rate in the near term than in the long term. However, price paths vary significantly across the AEO2017 side cases that differ in assumptions about U.S. resources and technology and global market conditions.

•Natural gas prices in the Reference case also rise and then remain relatively flat at about $5 per million British thermal units (MMBtu) over 2030–40, then rise again over the following decade (not shown on the graph). Projected U.S. natural gas prices are highly sensitive to assumptions about domestic resource and technology explored in the side cases.

United States crude oil and natural gas production depends on oil prices—as well as resource availability and technological improvements

•Projections of tight oil and shale gas production are uncertain because large portions of the known formations have relatively little or no production history, and extraction technologies and practices continue to evolve rapidly. Continued high rates of drilling technology improvement could increase well productivity and reduce drilling, completion, and production costs.

•In the High Oil and Gas Resource and Technology case, both crude oil and natural gas production continue to grow.

•Crude oil prices affect natural gas production primarily through changes in global natural gas consumption/exports, as well as increases in natural gas production from oil formations (associated gas).

•In the High Oil Price case, the difference between the crude oil and natural gas prices creates more incentive to consume natural gas in energy-intensive industries and for transportation, and to export it overseas as liquefied natural gas, all of which drive U.S. production upward. Without the more favorable resources and technological developments found in the High Oil and Gas Resource and Technology case, U.S. crude oil production begins to decline in the High Oil Price case, and by 2040, production is nearly the same as in the Reference case.

石油圈

石油圈