如今,油企剥离上游资产绝对是目光短浅的做法。如果油企能认真分析其投资组合的社会风险,或许不会轻易放弃上游领域不错的发展机会。

作者 | Jim Sisco etal.

编译 | 白小明

当前,特别是在各大产油区,社会风险(如罢工、抗议、诉讼、消极怠工和暴力等)发生的频率和规模都在增加,这些风险可能导致生产中断、供应链不稳,特别是在上游投资更密集的前端市场。社会风险分析可以帮助企业对其商业模式进行系统性改进,在项目的整个运行周期内保持经营的稳定,帮助企业规避风险,充分利用短期下跌的价格购买上游资产,从而在油价反弹时扩大市场份额。

2014年油价的下跌,加速了企业剥离上游资产的趋势。当前,剥离资产作为企业战略的一部分,可以帮助企业解决短期现金流缺口,从资产负债表中移除高风险资产,并通过更加可靠的下游业务来稳定现金流。

此外,大部分公司已经采取了传统的财务手段(如调整资本结构、裁员和减少股息支出)来降低损失,这些做法对于一心想维持季度利润以及降低短期风险的公司来说是合理的,但这些终究不是解决利润问题的可持续办法。例如,埃克森美孚不仅没有实现季度利润目标,反而在2016年第二季度获得了自1999年以来的最低收益。然而,即使面对持续减少的收益,企业仍在不断采取传统的手段。

受油价下跌影响,油气巨头们全面采取传统的金融措施。雪佛龙的现金流量从2014年的315亿美元减少到2015年的195亿美元,公司没有采取减少80亿美元股息的措施来弥补差额,反而采取了新增债务、出售资产,以及实施前所未有的裁员等措施。

当前,整个油气行业大部分公司的资本结构高杠杆化已非常明显了。埃克森美孚、荷兰皇家壳牌、BP和雪佛龙在过去两年的债务中增加了一倍以上。BP将其剥离资产计划从正常的20-30亿美元增加到了2015年的100亿美元,以应对油价波动。

雪佛龙在2016年实施了8000人的裁员计划,占其员工总数的12%;BP裁员4000人,占其上游员工总数的16%;康菲通过将股利从2015年第四季度的0.74美元/股降至了2016年第一季度的0.25美元/股,勒紧了投资者的腰带。相较行业标准做法,这种极端的方法也只能起到短期作用。

社会风险分析

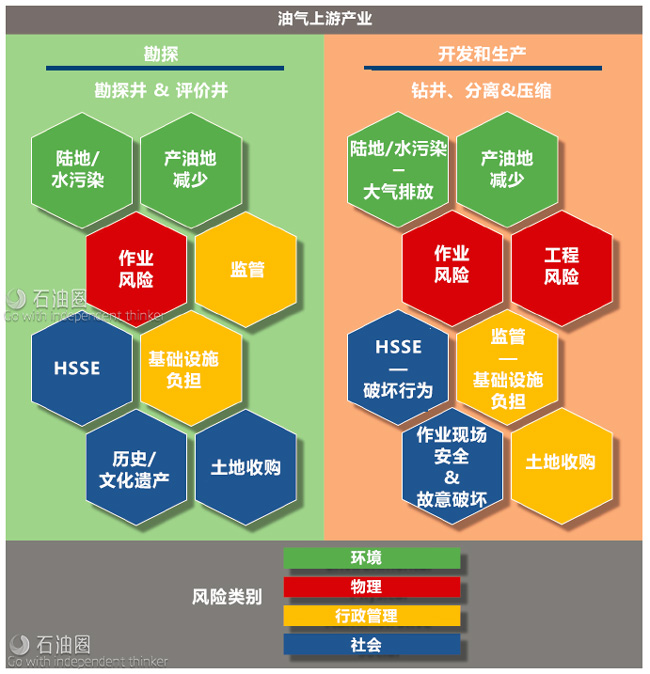

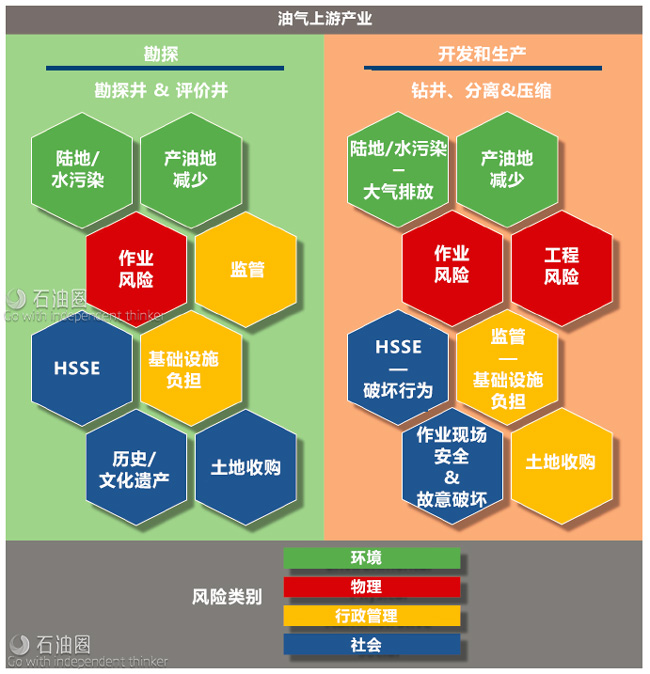

社会风险存在于整个油气产业链,影响上游业务(勘探&生产以及开发阶段),涉及环境、物理和行政管理风险。技术的创新有助于油气行业改善投资决策,可为企业提供大量数据,用于降低传统风险,但却无法探究问题的源头,以及预测和减轻社会风险。

在上游生产运营中,企业面临的这类问题尤为突出,由此造成的损失可能是巨大的。未识别或未缓解的社会风险,往往造成各种黑天鹅事件,或损失大量资金,或导致项目延迟数年。

通信技术的发展已使传统的风险分析方法过时,因此,即使公司雇佣了地缘政治专家、国家安全专家以解决特定地区的社会风险问题,也只能起到有限的作用。如今,大多数上游投资都处在不断变化的环境之中,需要采取社会风险分析。

当地居民,特别是靠近生产设施附近社区的居民,比以往任何时候都有更大的权力和影响力。社会活动家、环保团体和犯罪分子使用通信技术(如社交媒体、手机等)来掌控舆论,使社会产生不满情绪。这些团体通过大肆宣传,煽动抗议、罢工、诉讼或暴力,来改变大众的观念。

Energy Transfer Partners公司的达科他接入管道项目(Dakota Access Pipeline)便是因社会风险造成项目中断的典型例子。该管道设计用于将Bakken页岩、蒙大拿州和加拿大部分地区的原油输往美国墨西哥湾沿岸的炼油厂,输送能力为57万桶/天,管道长度超过1770公里。当地Standing Rock Sioux部落向联邦法院起诉要求停止管道建设,声称管道建设将毁坏重要的文化景点和他们继承下来的土地,并且危及水源供应。

最后,虽然他们败诉了,但该事件变成了暴力事件。据公司报告显示,该部落进行了有组织的抗议,一些人将自己绑到设备上,并烧毁和破坏各种设备,结果造成了超过300万美元的损失。随着公众的抗议声越来越大,原计划于2016年年底完成的管道建设项目,联邦政府于9月停止了高达38亿美元的投资。

目前,这种事件发生的频率正变得越来越高,已经成为了整个行业的家常便饭。反对污染和土地利用,以及侵犯当地居民的生存环境等因素,导致许多挑衅行为的发生,这也破坏了公司财产,造成了生产中断,对公司的盈利造成了负面影响。

其他例子包括Papua New Guinea当地的土地所有者抗议其与埃克森美孚的使用费协议,环保分子占领了位于Dorset’s Jurassic Coast的Infrastrata作业现场;其他案例还包括由于劳资纠纷,造成突尼斯的Petrofac天然气厂长达数月之久的停工。如果没有预测和减缓社会风险的方法,这些事件将造成上游投资成本过高,最终促使企业加大资产剥离战略的力度。

油企如何识别、减轻社会风险

社会风险分析提供了一套切实可行的解决方案,该方法可以衡量油气运营项目以及当地居民如何互相影响。结合开源信息(如社交媒体以及地方性新闻媒体)和高级数据分析技术,公司可以利用定量和定性数据精确识别、预测和减轻社会风险。

这不仅使公司能够了解其投资的真实风险水平,还可以作为基准,监测异常和偏差。例如,10000条抱怨工资太低的微博,会形成工厂员工的抗议。通过建立评估基准,企业可以确定造成重点问题的原因,更重要的是,企业可以制定缓解策略,积极消除任何可能造成生产中断的潜在风险。

社会风险分析为整个油气行业的各种业务提供有效的社会风险解决方案。将社会风险分析纳入到上游行业尽职调查中,能使公司主动量化可能造成巨大损失的潜在风险。在运营期间,公司可以通过主动参与,降低影响项目时间表和现金流的停工风险。通过更深层次的分析,可使公司更好地了解总体风险,创造机会战略性地收购错误估值的资产,或帮助公司更有效地管理当前设施的运营。

当前,许多油气公司正在减少上游项目,社会风险分析正好给企业带来了机遇,不仅可以帮助公司获得相对廉价的资产,而且可以创造持久的上游投资组合,以获得长期利润。对于具有战略性财务规划和长远布局的油企来说,目前进行上游投资可带来不可估量的增值潜力!

Actions by oil and gas firms to divest from upstream assets are short-sighted. Upstream investments present a golden opportunity for companies when social risk analysis is applied to their risk portfolios. Social risk (e.g., strikes, protest, litigation, sabotage and violence) are increasing in frequency and magnitude. They cause production disruptions and stoppages up and down the supply chain, especially in frontier markets where upstream investments are more prevalent. Social risk analysis enables firms to introduce systemic improvements to their business models, safeguard operations throughout the life cycle of the project, reduce their risk exposure, take advantage of short-term depressed upstream asset prices and position themselves to increase market share when commodity prices rebound.

The 2014 commodity downturn significantly accelerated an industry trend to divest from upstream assets. Today divestments are employed as part of a strategy to address short-term cash flow gaps, remove riskier assets from balance sheets and stabilize cash flow with more reliable downstream operations. In addition, firms have employed traditional financial methods (e.g., capital structure adjustments, employee layoffs and dividend payment reductions) to stop the bleeding. This approach is rational for firms focused on maintaining quarterly profits and reducing short-term risk. These measures have failed, however, to deliver a sustainable solution to protect profits. For example, Exxon Mobil not only missed its profit projections for the quarter ending June 30 but also reported its weakest earnings since 1999. Yet even in the face of continued lackluster earnings, firms have doubled down on traditional methods.

Oil and gas majors, hit hard by the commodity downturn, have taken traditional financial methods to the extreme. Chevron’s cash flow declined from $31.5 billion in 2014 to $19.5 billion in 2015. Instead of plugging the difference with a reduction in its $8 billion of dividends, Chevron raised new debt, sold assets and executed unprecedented layoffs. Changes to higher levered capital structures are evident across the industry. Exxon Mobil, Royal Dutch Shell, BP and Chevron have more than doubled their debt in the past two years. BP more than tripled its divestment program from a normal rate of $2 billion to $3 billion a year to $10 billion in 2015 in an effort to manage price volatility. Chevron is executing a plan in 2016 to cut 8,000 jobs, which comprises 12% of its workforce, and BP is cutting 4,000 jobs or 16% of its upstream workforce. ConocoPhillips has tightened the belt on equity investors through a dividend reduction from $0.74 per share in the last quarter of 2015 to $0.25 per share in first-quarter 2016. Even this drastic approach, by industry standards, is only a short-term fix.

Social risk analysis

Social risk exists throughout the entire oil and gas supply chain. It dominates upstream operations (E&P and development phases) and intensifies environmental, physical and administrative risks. Innovative technologies saturate the industry to improve investment decisions. They provide companies with unprecedented data to reduce traditional risks but fail to pinpoint, forecast and mitigate social risk. During upstream operations firms are especially exposed to this gap in their risk portfolio. The cost can be enormous. Extreme losses associated with black swan events and multiyear delays often are the result of unidentified or unmitigated social risk.

Proliferation of communication technologies has made traditional risk analysis obsolete. Moreover, geopolitical, country and security experts employed by companies to help navigate region-specific challenges offer only part of the solution. Today’s dynamic environments, where most upstream investments are made, require social risk analysis. Populations, specifically the communities in the vicinity of production facilities, have more power and influence than ever before. Activists, environmental groups and criminal networks use communication technologies (e.g., social media, cellphones, etc.) to amplify existing hostility and create grievances within a society. These groups shape perceptions through powerful narratives that instigate protests, strikes, litigation or violence.

Energy Transfer Partners’ Dakota Access Pipeline offers an example of disruption caused by social risk. The pipeline is designed to transport 570,000 bbl/d of crude over 1,770 km (1,100 miles) from the Bakken Shale, Montana and parts of Canada to oil refineries along the U.S. Gulf Coast. The Standing Rock Sioux Tribe sued in federal court to block the pipeline, claiming it would destroy important cultural sites and ancestral lands and endanger their water supply. They lost their case in court, and events turned violent. Company reports describe organized protests, individuals chaining themselves to equipment, and burned and vandalized construction equipment resulting in more than $3 million in damage. In the face of mounting public outcry, the federal government halted construction of the $3.8 billion pipeline in September, which was due to be completed by year-end 2016.

Events like these are becoming more frequent and the new industry norm. Resistance to pollution, land use and infringement on local livelihoods has led to defiant actions that damage company property, halt production and negatively impact profitability. Other examples include protests by landowners over royalty agreements with Exxon Mobil in Papua New Guinea, environmental campaigners’ occupation of Infrastrata’s site on Dorset’s Jurassic Coast and months-long work stoppages at Petrofac’s gas plant in Tunis due to labor disputes. Without a way to forecast and mitigate social risk, these events make upstream investment cost-prohibitive and reinforce divestment strategies.

Identifying, mitigating social risk

Social risk analysis delivers a solution. It measures how oil and gas operations impact populations and how populations impact oil and gas projects. Open source information (e.g., social media, local and regional news outlets) combined with advanced data analytics enable firms to leverage quantitative and qualitative data to pinpoint, forecast and mitigate social risk. This not only enables firms to understand the true risk level of an investment but also serves as a baseline to monitor for anomalies and deviations. For example, will 10,000 angry tweets over low wages translate into a protest at a facility? With a baseline assessment established, firms can determine if this is cause for concern and, more importantly, develop mitigation strategies to proactively quell any potential work disruptions.

Social risk analysis provides utility across the entire oil and gas business model. Integrating social risk analyses into upstream due diligence investigations allows firms to proactively quantify the potential for extreme losses. During operations companies can lower the risk of work stoppages that affect project timelines and cash flows through active engagement. The additional layer of analysis enables firms to better understand total risk exposure, creating opportunities to strategically acquire mispriced assets or to more effectively manage operations at current facilities. In today’s market where many oil and gas firms are divesting upstream assists, social risk analysis provides a unique opportunity to not only acquire relatively cheap assets but also to create an enduring upstream portfolio to protect long-term profits. For companies with a more strategic financial strategy and long-term outlook, upstream investments offer incredible upside potential.

未经允许,不得转载本站任何文章:

-

- 甲基橙

-

石油圈认证作者

- 毕业于中国石油大学(华东),化学工程与技术专业,长期聚焦国内外油气行业最新最有价值的行业动态,具有数十万字行业观察编译经验,如需获取油气行业分析相关资料,请联系甲基橙(QQ:1085652456;微信18202257875)

石油圈

石油圈