Central Asia-China Gas Pipeline

Oil is getting much cheaper to produce from shale formations using advanced techniques and horizontal drilling. Shale oil is threatening to push out OPEC-sourced imports as a major source of supply. And in the future it could get even more difficult for those wishing to export oil to the U.S. as President-elect Trump touts energy self-sufficiency.

Should OPEC producers be worried? And what about Canada, another major exporter of crude to the U.S.?

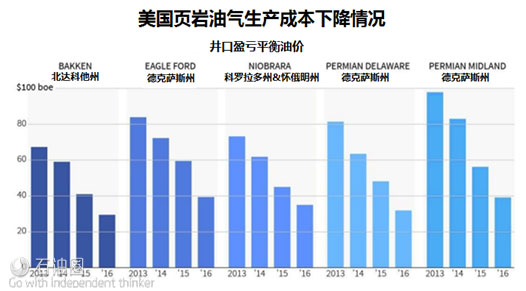

Shale oil is getting cheaper to produce; about 47 percent less expensive on average according Rystad Energy’s senior analyst, Bielenis Villaneuva-Triana, in a recent report.

In the five major producing areas in the U.S., the cost of oil using horizontal-drilling from shale basins declined to less than $40 per barrel, with the Bakken formation of North Dakota the least expensive at $31/barrel. For reference, cash costs per barrel produced by Suncor in the Canadian oil sands was $27.65 per barrel, according to the company’s third quarter results.

This cost decline brings into question the OPEC strategy of cutting back production by 1.2 million barrels/day (bpd), while asking non-OPEC producers like Russia to contribute cuts of about 600,000 bpd. The OPEC cuts might not help OPEC as they might just make room for the U.S. shale producers to expand their production by a similar amount. Here are the shale oil (also called tight oil) producing areas: Major tight oil and shale gas regions in the U.S.

The biggest of those is the Permian Midland Basin. Recent surveys of that area, which crosses the border between Texas and New Mexico, indicate as much as 20 billion barrels in new discoveries.

A CNN news story recounted the increase in Permian Basin oil reserves.

From the U.S. Geological Survey:

“Even in areas that have produced billions of barrels of oil, there is still the potential to find billions more,” Walter Guidroz, coordinator for the USGS Energy Resources Program said in a statement. “Changes in technology and industry practices can have significant effects on what resources are technically recoverable, and that’s why we continue to perform resource assessments throughout the United States and the world.”

The shale industry, which uses hydraulic well fracturing or “fracking” to recover oil suspended in shale, provides about one-half of total U.S. crude production, or about 4.5 million bpd. And there’s a good chance that the new-elected government might give shale a further boost.

President-elect Donald Trump campaigned on his “An American First Energy Plan.”

Here’s an excerpt:

Declare American energy dominance a strategic economic and foreign policy goal of the United States.

Unleash American’s $50 trillion in untapped shale, oil, and natural gas reserves, plus hundreds of years in clean coal reserves.

Become, and stay, totally independent of any need to import energy from the OPEC cartel or any nations hostile to our interests.

Open onshore and offshore leasing on federal lands, eliminate moratorium on coal leasing, and open shale energy deposits.

Encourage the use of natural gas and other American energy resources that will both reduce emissions but also reduce the price of energy and increase our economic output.

Trump’s plan goes on to suggest that the shale oil industry could create 2 million new jobs in seven years.

How would these changes affect Canada?

Canada is the biggest exporter of crude oil to the U.S. and most of that comes from northern Alberta, from heavy oil and bitumen deposits.

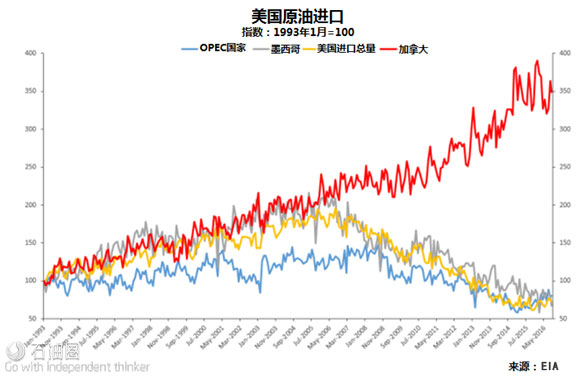

According to the Energy Information Administration, since 1993 Canada’s exports to the U.S. have almost quadrupled to more than 3.7 million bpd in September of this year, while OPEC has been cut back. Recently Canada’s sales have levelled off but remain near record levels and ahead of OPEC’s 3.6 million bpd.

OPEC’s goal of increasing the price by cutting production could prove elusive. If the U.S. shale industry can find the workers, and if President-elect Trump relaxes some regulations, there could be a HUGE increase in U.S. production. OPEC’s cuts of 1.2 million bpd could lead to shale oil’s increased production of a similar amount.

The American home-grown energy policy could benefit or hurt Canada, depending on the Canadian industry’s ability to get costs down to a level that matches the U.S. shale industry, including transportation and pipeline access. Recent news on the pipeline front has been promising but, for Canadians, increased market access will only arrive when the oil is flowing.

石油圈

石油圈