Energy Insights expects oil drilling activity levels to mostly rebound to 2014 levels in the next 5 years if oil prices recover to ~$60-70/bbl, however crude oil production capex in upstream markets will remain 20% below 2014 highs.

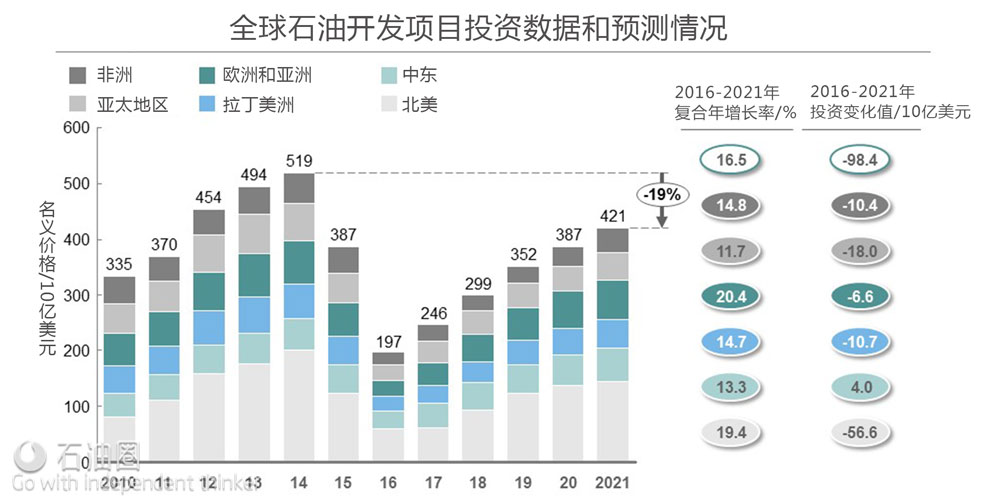

Capital expense in global oil production, including greenfield and brownfield projects and maintenance, recorded 11% p.a. growth between 2010 and 2014, hitting an all-time high of ~USD520 billion before the oil price crash. 2 years on, capital expenditure has declined by more than 60% to an estimated ~USD200 billion in 2016.

The collapse was driven by 2 main factors:

i) the reduction in drilling activity for projects deferrals and cancellations as companies struggled to conserve cash and

ii) lower service costs as oversupply on the services supply side led to 20-50% reductions (e.g., rig rates). We estimate that two thirds of the oil production capex reduction was due to the first driver, while factor costs explained the remaining third. However, this split was not even across all resource types.

The decline in drilling activity was particularly visible in North American light tight oil (LTO) basins where it accounts for almost 80% of the estimated USD65 billion reduction in development capex between 2014 and 2016. The short development cycles of LTO wells allowed producers to respond to the price collapse quickly. The North American horizontal rig count went down by 50% in only 9 months after the price collapse as the LTO producers became some of the first producers to stop drilling new wells.

Worldwide Recovery In Land Drilling Rig Market Expected By 2020

About 16% of the North American fleet has been scrapped since January 2015, Douglas-Westwood said. (Photo by Tom Fox, courtesy of Oil and Gas Investor)

At midday Aug. 11 the West Texas Intermediate price jumped $2.06 to $43.77, regaining much of the ground lost over the previous days. The price rollercoaster was in full swing, showing that forecasters still aren’t sure what direction prices are headed. Drilling contractors are hoping the upswing will continue.

Douglas-Westwood sees a silver lining on the storm clouds. In its World Land Drilling Rig Market Report, the company forecasted continued compression of the market in 2016 but market recovery over the following four years.

“The downturn in commodity prices had a significant impact on onshore drilling activity in 2015, with the total number of onshore wells drilled declining by 32% from 90,784 to 61,873 wells. This reduction in drilling activity had a detrimental effect on rig demand, with the global number of operational rigs falling by 25% from 6,334 to 4,746. The number of rigs engaged in drilling activity experienced a similar decline, falling by 24% from 5,427 units to 3,965, with Eastern Europe and the former Soviet Union [FSU] being the only region not to witness a reduction,” said Katy Smith, analyst and report author for Douglas- Westwood.

“Following announcements of further reductions to capital expenditure for 2016, Douglas-Westwood expects an additional decline in onshore drilling activity to result in further compression to the land rig market as operators adjust to working in a sustained low oil price environment. The global number of onshore wells drilled is forecast to decline by a further 21% in 2016, resulting in a 24% reduction in the number of rigs drilling,” she explained.

There is some light at the end of the tunnel. “The global number of onshore wells drilled is expected to increase at a compounded annual growth rate of 9% over the next four years from 49,128 wells in 2016 to 69,407 wells in 2020,” Smith said.

“Subsequently, the global number of rigs drilling is forecast to rise by 38% from 3,414 units in 2016 to 4,703 rigs in 2020. The global capable fleet size is expected to increase by 188 units over the forecast period, reaching 9,255 units by 2020. Eastern Europe and the FSU will account for approximately 49% of the additional units to the fleet, as increased horizontal drilling activity in Russia results in rising demand for high-HP [horsepower] rigs,” she said.

Some areas could impact the rig count even more. “In Asia-Pacific, the total number of rigs drilling is forecast to increase by 8% over 2016 to 2020 despite a marginal decline in drilling activity. This is due to increased geological complexity as China seeks to develop its unconventional reserves,” Smith said.

It is encouraging to hear some positive forecasting for a change.

About 16% of the North American fleet has been scrapped since January 2015, Douglas-Westwood said. (Photo by Tom Fox, courtesy of Oil and Gas Investor)

At midday Aug. 11 the West Texas Intermediate price jumped $2.06 to $43.77, regaining much of the ground lost over the previous days. The price rollercoaster was in full swing, showing that forecasters still aren’t sure what direction prices are headed. Drilling contractors are hoping the upswing will continue.

Douglas-Westwood sees a silver lining on the storm clouds. In its World Land Drilling Rig Market Report, the company forecasted continued compression of the market in 2016 but market recovery over the following four years.

“The downturn in commodity prices had a significant impact on onshore drilling activity in 2015, with the total number of onshore wells drilled declining by 32% from 90,784 to 61,873 wells. This reduction in drilling activity had a detrimental effect on rig demand, with the global number of operational rigs falling by 25% from 6,334 to 4,746. The number of rigs engaged in drilling activity experienced a similar decline, falling by 24% from 5,427 units to 3,965, with Eastern Europe and the former Soviet Union [FSU] being the only region not to witness a reduction,” said Katy Smith, analyst and report author for Douglas- Westwood.

“Following announcements of further reductions to capital expenditure for 2016, Douglas-Westwood expects an additional decline in onshore drilling activity to result in further compression to the land rig market as operators adjust to working in a sustained low oil price environment. The global number of onshore wells drilled is forecast to decline by a further 21% in 2016, resulting in a 24% reduction in the number of rigs drilling,” she explained.

There is some light at the end of the tunnel. “The global number of onshore wells drilled is expected to increase at a compounded annual growth rate of 9% over the next four years from 49,128 wells in 2016 to 69,407 wells in 2020,” Smith said.

“Subsequently, the global number of rigs drilling is forecast to rise by 38% from 3,414 units in 2016 to 4,703 rigs in 2020. The global capable fleet size is expected to increase by 188 units over the forecast period, reaching 9,255 units by 2020. Eastern Europe and the FSU will account for approximately 49% of the additional units to the fl eet, as increased horizontal drilling activity in Russia results in rising demand for high-HP [horsepower] rigs,” she said.

Some areas could impact the rig count even more. “In Asia-Pacific, the total number of rigs drilling is forecast to increase by 8% over 2016 to 2020 despite a marginal decline in drilling activity. This is due to increased geological complexity as China seeks to develop its unconventional reserves,” Smith said.

It is encouraging to hear some positive forecasting for a change.

The effect of the two drivers was closer to 50/50 in offshore capital expense. 3+ year-long development cycles in deep water projects make offshore production relatively inelastic to changes in oil prices in the short term. On the flip side, capex deflation/compression affects deep water production capex more than onshore as, on average, the share of development capex in total cost is higher in deepwater.

In the next 5 years, under the “Slow Recovery price scenario” (prices increase to $60-70/bbl by 2018), we see drilling activity levels rebounding to 2014 levels by 2021, except for the US. However, despite growing strongly at 16%p.a. between 2016 and 2021, global oil production capex spending is expected to stay 20% short of 2014 highs and hover around USD420 billion in 2021. The main reason is cost compression as oil prices are likely to be lower than they were before the price collapse, keeping a lid on rig rates and other factor costs.

Regionally, capital expenditure in oil production in the Middle East will recover the fastest and reach 2014 levels by 2020. Growth in spending is driven by a forecast 13%p.a. increase in drilling activity between 2016 and 2021 reflecting the production growth of OPEC Gulf members, in particular Saudi Arabia, Iran, and Iraq.

Oil production capex in North America is expected to grow at 19%p.a. through 2021.This is driven mostly by a rebound in LTO accounting for 80% of the total increase in USD terms, whereas oil sands and conventional spending growth stays relatively low. On the deepwater side, oil production capex in both Africa and Latin America will catch up with 2014 levels towards the end of the forecast period.

Capex in Angola and Nigeria deep water developments will nearly double between 2016 and 2021 from USD4 billion to USD8 billion in both countries. We expect Mexico to drive the majority of the deep water capital spending growth in Latin America, growing by 25%p.a. between 2016 and 2021 albeit from a very small base. Brazil, on the other hand, is expected to grow at 5%p.a. during the same time period as we expect drilling activity to be lower than previously expected due to Petrobras cash constraints and serious FPSO delays in pre-salt projects.

石油圈

石油圈