As oil prices have halved, operators are trying to transform their cost base. Under certain conditions the reduction potential can be as high as 50 percent.

Returns on capital in the oil and gas (O&G) sector have halved since 2007, and even when the price of oil was $100 USD/bbl many operators were struggling to fulfill their capital commitments. Now that the oil price has halved, it is clearer than ever before that there is a strong need for operators to transform their cost base. And well delivery, which on average accounts for 40 percent to 50 percent of the capital spending for exploration and production, is a good starting point. McKinsey believes that the reduction potential can be as high as 50 percent when multiple levers can be optimized simultaneously.

Most operators have tried to curb their capital costs, most recently and particularly what they spend on drilling. Several operators have succeeded by focusing on operational improvements, such as reducing non-productive time (NPT), optimizing procurement practices or by better managing performance.

Through our services to various operators around the globe, McKinsey has come to believe that in certain cases, it can be possible to achieve up to a 50 percent reduction on a costs per well basis across a portfolio of offshore wells. The full potential, however, depends on current performance and can only be achieved when an operator employs in concert most or all of the cost-reduction levers we present here. Such an undertaking takes a great deal of effort and may generate resistance, but the potential upside obviously is huge.

Fifty percent reduction of offshore drilling spend is possible

For an average offshore O&G operator, drilling and completion (D&C) accounts for about 40 percent to 50 percent of total capital expenditure; for many onshore operators, D&C expenditures can be as high as 65 percent. These costs include different types of wells; production, development and exploration, and sometimes plugging and slot recovery too. On average, half of this cost is in leasing rigs and the remaining half is in equipment, engineering services, consumables, and project management. For offshore wells, about 70 percent to 80 percent of these costs are time related, suggesting that any compression in delivery time will have a direct benefit to the bottom line.

The average costs of an offshore well have risen by 200 percent to 250 percent since 2007. Key contributors to this increase are:

• Higher rig rates (100 percent to 150 percent of the increase, in certain basins and rig classes even more.)

• Higher well and completion costs (25 percent to 50 percent) driven by a greater use of expert services, more complex designs, and more expensive technologies.

• Process inefficiencies (50 percent to 75 percent) related to engineering productivity issues, last-minute changes, weak-performance cultures, and broken learning curves.

Several cases have shown us that operators can achieve cost reductions of up to 20 percent by optimizing even a limited set of levers. For example:

• One company operating mainly in the Gulf of Mexico achieved a 19 percent reduction in average offshore well costs simply through a structured and ambitious effort to improve its procurement and supply chain. It achieved this reduction in large part by simplifying well design and encouraging competition among its vendors for commodity services and products.

• A large international operator achieved a 16 percent average reduction in D&C costs across a portfolio of over 100 offshore wells. It set strict targets for acceptable well costs and pruned specifications and designs accordingly. In order to assure quality, it based its revised specifications on documented industry practices and standards and had them reviewed by an internal board of drilling specialists before it applied them to the procurement process.

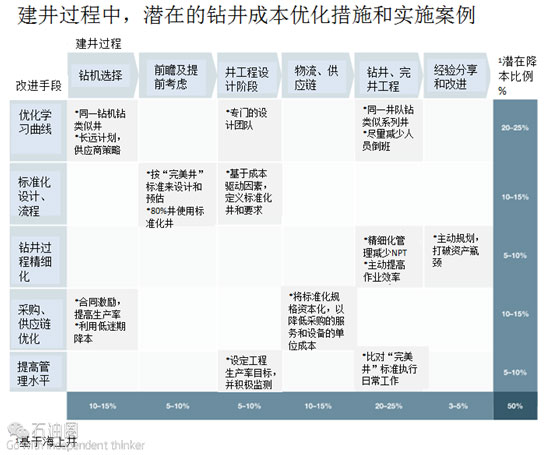

The exhibit summarizes potential well-cost reduction measures across many operators and illustrates how an all-inclusive and concerted effort can realize improvements that many may believe impossible.

What to do to reduce offshore drilling costs by 50 percent

In order to maximize cost reductions, a company needs to optimize these five levers together:

1.Probably the most fundamental cost reduction driver is to drive learning curves through rigorous portfolio and planning optimization at all levels to prevent overwork and make the learning curve less steep. Optimizing this lever can achieve an up to 20 percent to 25 percent reduction in the average cost per well. There are three elements to this driver:

Maintain a stable, overarching drilling portfolio plan for one-to-three years. A stable plan lays the foundation for long-range planning for all the stakeholders and suppliers for well delivery. In McKinsey’s work in this field, the number one priority for many suppliers is to achieve better transparency and predictability in drilling activities. Transparency is critical. It allows all parties to improve planning and make their services more streamlined and efficient.

Stabilize well delivery plans for the entire drilling portfolio. Wells and their designs often depend on each other and plans tend to change based on the latest insights and developments. Therefore, drilling teams are often unable to plan in advance, resulting in suboptimal logistics and rig allocation. Locking in the drilling plan allows for optimizing rig allocation, rig movement, the logistics for specialized equipment, and how a company mans its rigs. In order to stabilize the drilling plan and plan ahead, all stakeholders (for example, reservoir engineering, asset management, and drilling) need to align and commit to predetermined results.

Cluster similar wells in order to create repetitive jobs for drilling crews. Standardizing on well types reduces the amount of learning that a team has to do across a number of wells. Specialized crews should be able to get up to speed faster—and thus at lower cost—compared to regular teams. Examples indicate that drilling teams repeating very similar activities on 10 or more wells become 30 percent to 40 percent more efficient over just a few months than teams executing these activities for the first time or infrequently. For example, in an offshore field in the North Sea, an operator has managed to drive down average D&C time per well by nearly 30 percent over three years in this way. It applied a strict design standard for inherently complex designs (such as multilaterals and advanced completions) and worked with a single rig operator and stable crews repeating the same activities.

2.Standardize and simplify wells to reduce unit costs has a proven cost-reduction effect and enables improvements in several other related areas. The potential cost reductions of up to 10 percent to 15 percent arise through several mechanisms:

A reduced number of items for use in well designs (for example, a limited number of completion packages). This results in short-term savings in procurement, mid-term maintenance, and long-term plugging and abandonment (P&A).

Once drilling has begun, perhaps surprisingly, standardization leads to more flexibility and agility. For example, when operators encounter a different geology than they expected, and they need to alter the well’s trajectory, the warehouse will have the necessary parts available. Clearly, this is more efficient—and less costly—than waiting for new parts to be ordered and delivered.

Last but certainly not least, standardization serves to limit the increasing (and not always justifiable) trend toward complexity in well design. Standardization forces engineers to design wells within rational boundaries.

3.Lean initiatives to reduce non-productive time (NPT) and improve efficiency. This lever is a collection of many smaller efforts that have been proven to provide at least a 5 percent to 10 percent reduction in total well delivery costs. Applying a normal lean toolkit to prevent rework, reduce waiting time, eliminate contingencies, and enable processes to be executed in parallel instead of in sequence can cut NPT in half. For example, a midsized operator in Southeast Asia reduced NPT from an average of nearly 16 percent to 9 percent by attacking it in a structured and consistent way over little more than a year. As mentioned before, a large part of the costs of a well are time related; therefore, any reduction in NPT directly reduces cost and goes to the bottom line.

4.Procurement and supply chain management (SCM) is a key driver of cost reduction as 90 percent of the industry’s capital spending and 70 percent of its operational expenses are for contracted services and products. Basic procurement best practices can take operators some of the way toward the 50 percent reduction target in drilling costs—about up to 10 percent to 15 percent. However, this requires a fundamental rethink of commercial models and an aggressive approach to taking advantage of the current market downturn. Many believe the downturn may offer even greater potential savings. For example, we have already seen rig day rates down as much as 30 percent in certain regions and for some rig classes. More advanced SCM practices include working closely with rig operators to develop designs and drilling approaches that remove idle time, reduce the use of third party services and expensive downhole equipment, and increase drilling speed. Some operators have successfully used alternative compensation strategies to align service provider incentives with company objectives, focusing, for example, on time-to-delivery rather than fixed day rates. Others, however, have struggled to sustain the benefits of such strategies, and in our experience companies need to implement strict performance management processes and benchmark to preserve the savings they retrieve from SCM improvement initiatives.

5.Rigorous performance management is required to revitalize the performance drive, and that alone has been proven to reduce up to 5 percent to 10 percent of the well cost. As wells are hard to compare, and operators perceive each drilling job as very different, they tend to resist ambitious targets for time improvements. However, it becomes far easier to set bold targets when the drilling plan is standardized and optimized for recurring jobs.

You can do it

Even though optimizing all these cost-reduction levers in a single effort might seem hard, it is possible. The current oil price environment should be a sufficient incentive to bring all stakeholders to the table to kick off the required transformation. Realizing all the possibilities for well cost reduction requires an all-inclusive well delivery optimization program that includes the entire value chain and all the relevant stakeholders. To make such a program a success, several elements need to be in place:

•A clear baseline including improvement targets. A good baseline creates cost transparency within the organization and leadership and gives operators the ability to track well-cost improvements. As average well cost largely depends on the composition of the well portfolio, calculating improvements is not straightforward. To create realistic improvement targets requires a clear baseline of historic costs per well. The targets can be differentiated by geography and type of well, and by category of expense (rigs, third-party well services, consumables, internal engineering hours, and so on). Lastly, the results of any improvement initiative should differentiate benefits due to improvements in productivity and efficiency from those generated by changes in the portfolio or well design, or even external, unrelated factors.

•Senior management change drive. As internal resistance to changes in well delivery is likely to be high, it’s critical for senior management to get behind any initiative. Management should clearly define and communicate the organization’s needs and prepare a clear change story to translate well-cost targets into the budgets and goals for both the well delivery organization and the asset management team. If those teams retain the budget and freedom to continue their old practices, it is unlikely they will agree to implement simplified well concepts or push for improvements.

•Technical toolkit. To enable the drilling teams to implement standardized and simplified wells, as well as lean drilling improvements, they need a technical toolkit. This toolkit should include:

A clear explanation of the design choices that drive well costs and complexity (for example, the optimal length of the reservoir section; the implications of different completion types). Also a best-practices bundle of well concepts that can ease the improvement initiative roll-out and implementation.

An overview of those lean best practices and frameworks required in analyzing and optimizing drilling performance

International benchmarks to compare drilling performance and well costs for different geologies

•Rig-release strategy. A reduction in average well cost does not translate automatically into a bottom-line capital expenditure reduction unless the company executes a robust rig-release strategy. Remember: Because most costs are time-related, cutting average costs by reducing complexity and introducing lean measures will only result in freed up rig capacity. For cost-per-well savings to translate into bottom-line savings, the total rig spend needs to go down. For most mobile rigs, cold stacking does not result in bottom line savings. Rather, reducing the total number of rigs is the most effective way to realize bottom line savings. However, as contract lead times tend to be long, it is important that operators identify the number of rigs they should release at an early stage.

•Program management office (PMO) and active stakeholder management. A PMO is essential for tracking improvements, sharing concepts and ideas, and aligning stakeholders. The PMO needs sufficient authority to hold people accountable for meeting improvement targets, and it’s unrealistic to imagine reducing costs across the organization without one.

Obviously, there are barriers to achieving a 50 percent reduction of well costs. The most important may be the perceived or real lack of flexibility in the organization’s approach to delivering wells. When optimization is focused solely on delivering the well fast in a resource-constrained but high-oil-price context, continuous improvement and customization of well designs and specifications make sense. However, it is our experience that companies manage, and in most cases reduce, customization, particularly when it occurs late in the engineering and planning process and affects costs the most.

石油圈

石油圈